Dispute Management

The Dispute Management API is an efficient way to automate and manage your disputes process. This is ideal for conducting near real-time retrieval operations for disputes data, including obtaining a list of disputes, accessing details of specific disputes, retrieving the status of multiple disputes, and getting issuer documents. Additionally, performing dispute related actions such as challenging, fulfilling, and accepting.

Availability

The Dispute Management API is available for use in the following regions:

- United States

- Canada

- Europe

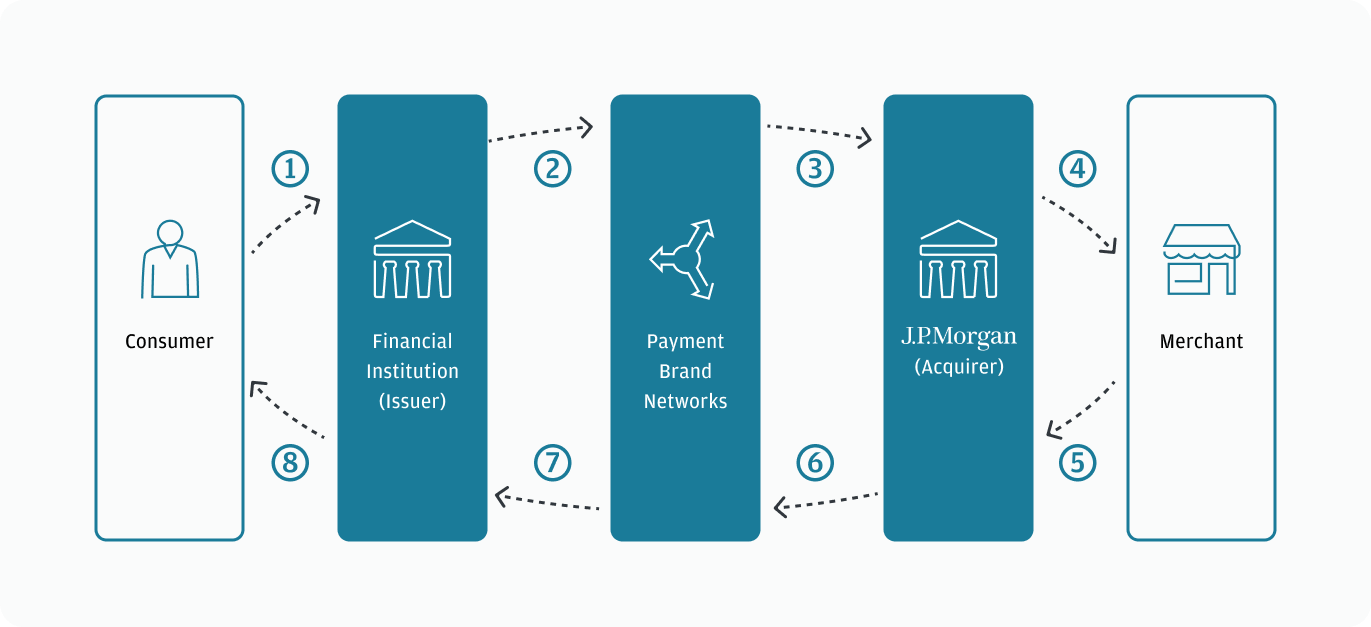

How disputes work

- Your consumer contacts the card issuer to dispute a transaction.

- Card issuer researches, confirms dispute eligibility, and submits the dispute to the payment brand.

- Payment brand electronically screens the dispute for technical compliance and forwards it to J.P. Morgan (Acquirer).

- J.P. Morgan receives the dispute and performs one of the following actions:

- Resolves the issue, returns it to the payment brand (skip to step 6), and notifies you.

- Forwards the issue to you for further analysis.

- Resolves the issue, returns it to the payment brand (skip to step 6), and notifies you.

- You can then determine if the dispute is valid and perform one of the following actions:

- If valid, you send a response to J.P. Morgan to accept the dispute.

- If not valid, you send the dispute back to J.P. Morgan with supporting documentation to return to the issuer as a representment.

- If valid, you send a response to J.P. Morgan to accept the dispute.

- J.P. Morgan forwards the item (accepted or represented) to the payment brand.

- Payment brand electronically screens the item for technical compliance and forwards it to the issuer.

- Issuer receives the item, reviews it, and performs one of the following actions:

- If you accept the dispute, the consumer is notified accordingly.

- If you respond with a representment and the issuer agrees, the consumer is notified accordingly.

- If you respond with a representment and the issuer does not agree, the dispute continues and a second dispute is submitted (PRE_ARBITRATION). The cycle repeats.