Understanding how Automated Clearing House (ACH) payments work

2 October 2025

What are ACH payments?

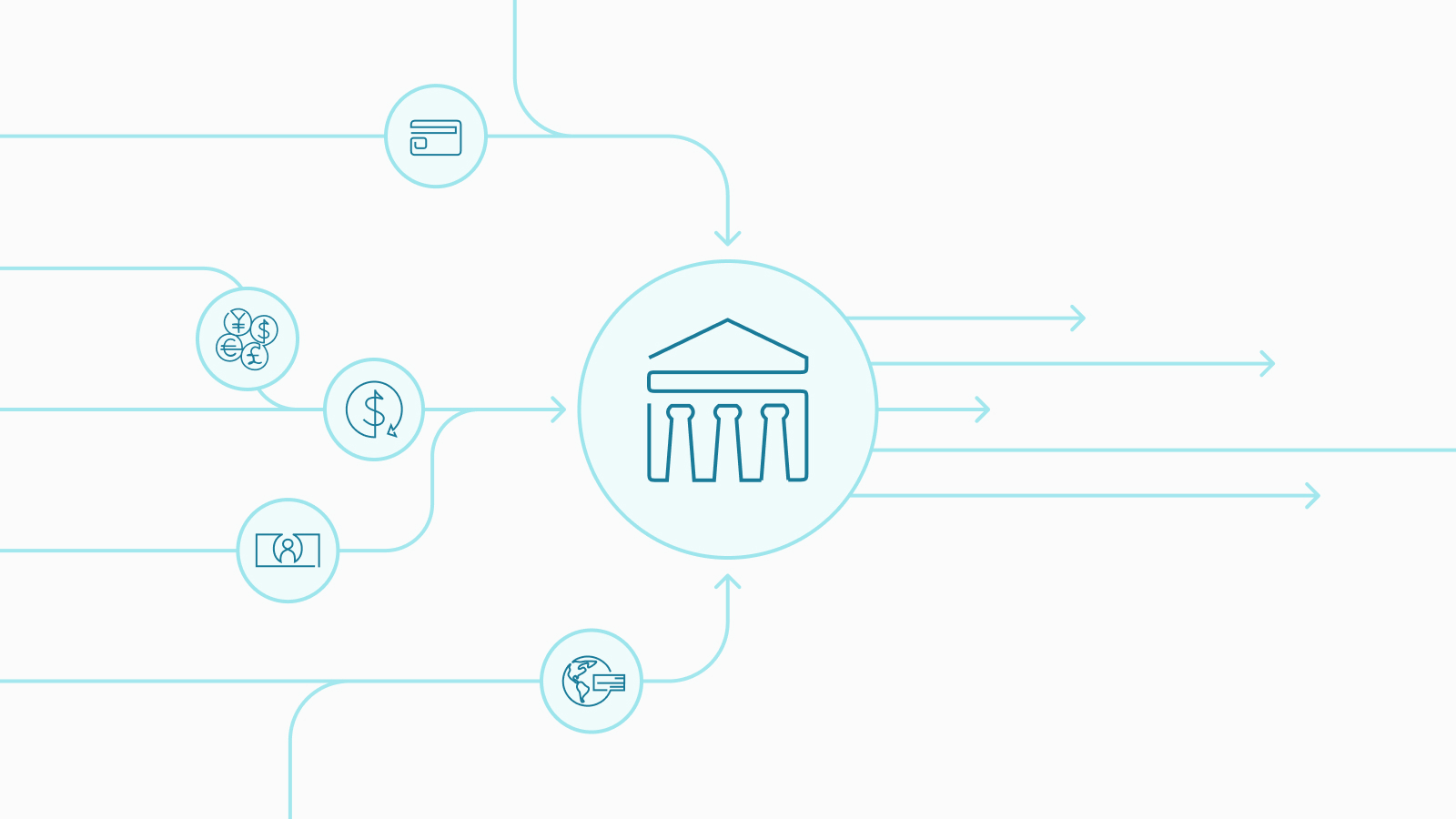

ACH is an electronic funds transfer system in the U.S. that processes batches of transactions between financial institutions. It's a popular method for non-urgent payments such as payroll, vendor payments, and recurring billing.

ACH payments are made through batch processing, so instead of sending funds immediately, like a wire or a real-time payment, ACH groups transactions together and processes them at set intervals. This approach minimizes the strain on technological resources, enabling banks to handle high transaction levels effectively, reducing operational costs.

How batch processing works in ACH

In the ACH system, transactions are collected throughout the day and bundled into batches, which are then submitted to ACH operators like the Federal Reserve or the Clearing House at scheduled times. Once received, these operators process the batches and send them to recipient banks, which complete the settlement process. The batches generally settle the next business day or can be processed same-day if they meet cutoff times under Same-day ACH rules.

This system keeps transaction fees lower, making ACH ideal for handling large volumes of routine payments.

Whether you're expanding your business's payment capabilities or just looking for ways to streamline routine transactions, ACH payments are a reliable, cost-effective solution.

Benefits and common business applications of ACH

ACH payments are widely used in business for several key applications, especially for transactions that don’t require immediate processing. Some of the most common uses include:

- Payroll processing: ACH is ideal for direct deposit payroll, allowing businesses to pay employees efficiently. For example: A national retail chain uses ACH for biweekly employee payments, saving on costs associated with manual check distribution.

- Vendor and supplier payments: Businesses often use ACH to pay suppliers, streamlining routine transactions. For example: A mid-sized manufacturing company uses ACH to pay its domestic suppliers, ensuring payments are processed on time with minimal effort.

- Automated bill payments: Many companies set up automated bill payments for utilities, insurance, and leases. For example: An IT services firm automates its monthly lease payments for office spaces using ACH, ensuring it never misses a due date.

- Subscriptions and membership fees: ACH is often used for recurring payments.

For example: A cloud-based software provider might rely on ACH to process monthly subscriptions from its users. - Tax and government transactions: ACH is also the go-to method for tax payments and other government-related transactions.

For example: A logistics company, for example, uses ACH to pay its quarterly federal taxes.

Is ACH the best choice for international transactions?

While ACH is a reliable method for domestic payments, there are limitations when it comes to international transactions. ACH is primarily used within the U.S., so businesses that need to handle cross-border payments often turn to other methods such as:

- SWIFT: A secure messaging network for international payments

- SEPA: The Single Euro Payments Area (SEPA) is an EU-based system similar to ACH

- Blockchain and Cryptocurrencies: Offering decentralized, borderless payments, blockchain is emerging as an alternative for certain transactions

Businesses operating on a global scale often use a combination of these payment methods alongside ACH to optimize their payment strategy for both domestic and international needs.

Future of ACH payments

Even as faster and more modern payment methods emerge, ACH remains crucial to businesses. Its reliability and cost-efficiency make it indispensable for businesses making predictable payments like payroll and vendor disbursements.

By partnering with a large bank like J.P. Morgan, businesses can leverage the full power of ACH alongside more advanced payment rails, ensuring they have a scalable, secure, and flexible payment infrastructure for both domestic and global operations.

Partnering with J.P. Morgan for ACH Payments

J.P. Morgan Payments has made available our comprehensive Global Payments API. The all-in-one API supports not only ACH payments, but also Real-Time Payments (RTP), Push to Card (P2C), and blockchain-based payments.

Although ACH is limited to U.S. payments, J.P. Morgan’s global network supports international transactions through systems like SWIFT and SEPA, helping businesses expand their payment infrastructure with limited friction.

Explore the API documentation and references to learn more. Or contact us if you have questions.