ACH

ACH is a payment rail that lets you transfer funds between a J.P. Morgan account and another bank account through an automated clearinghouse.

An automated clearinghouse is an electronic network that’s overseen by an operator, and facilitates the transfer between J.P. Morgan and the other bank. It processes a batch or batches of ACH payments on business days.

ACH typically costs less than other payment rails because of bulk processing and lower processing fees. It requires payment initiation by specified cutoff times for the funds to become available on corresponding settlement dates, which can range from the same business day to several business days.

There are two types of ACH payments: Credit Transfers and Direct Debits (available in select markets). In a credit transfer, the originator initiates the transfer of funds from their bank account to the recipient's bank account. This type of transaction is often used for direct deposits, such as payroll and tax refunds. In a direct debit, the originator initiates the transaction to pull funds from the receiver’s bank account. This is commonly used for recurring payments, such as utility bills or subscription services.

Benefits

- Cost-effectiveness: A low-cost solution for non-urgent payments.

- Credits and debits: One payment rail that meets collection and payable needs.

- Speed and safety: Fast and secure payments that settle on the same business day, following business day, or following business days.

When to use ACH

Payroll payments

Deposit employees’ salaries, wages, reimbursements, and benefits directly into their bank accounts in a secure and cost-effective way.

Supplier and vendor payments

Pay suppliers and vendors online, and avoid the processing and later settlement dates associated with checks and corporate cards.

Bill and tax payments

Pay bills and taxes directly from bank accounts through one-time or recurring payments.

Customer reimbursements and refunds

Issue refunds or reimbursements that reach customers in a few days.

Wallet top-ups and withdrawals

Top-up stored-value digital wallets directly from bank accounts and withdraw excess money directly into bank accounts.

How ACH works

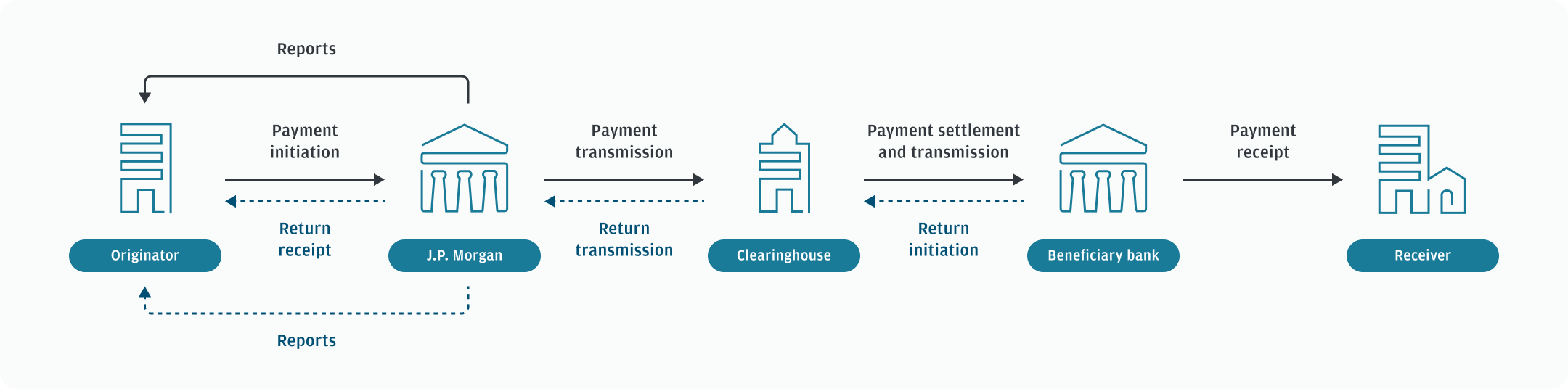

The following image illustrates a high-level overview of an ACH payment.

The solid arrows show the flow of an ACH payment that succeeds and the dotted arrows show the flow of an ACH payment that fails.

Availability

The following table contains the regions and countries where ACH is available for Global Payments API initiation:

| Region | Country |

|---|---|

| Latin America (LATAM) | Chile |

| North America (NA) |

United States |

Next steps

- Learn about the required payment parameters to initiate an ACH credit payment.

- Learn about the required payment parameters to initiate an ACH debit payment.