Receivables

QR codes

A QR code is a graphic representation of a payload that can be linked to a Payment Request, enabling digital payment. A QR code can be static or dynamic, depending on the payment scenario.

- Static QR codes contain a fixed set of information such as the transaction Id, payment beneficiary details, and the payment amount. These codes are commonly used by small businesses, physical stores, and for peer-to-peer (P2P) transactions.

- Dynamic QR codes are more flexible and are linked to a URL, allowing the payment details such as payment due dates and payer data to be modified as needed. Dynamic QR codes are commonly used by online retailers and payment processors.

When to use QR codes

The following table shows the differences between QR code types for the Request to Pay API:

| Static | Immediate (Dynamic) | With due date | |

|---|---|---|---|

| Amount | Optional field. When specified, the payer can not change the value unless it is zero. | Pre-determined amount. The client can define if a different payment amount can be accepted. | Pre-determined amount. Interest, penalties, deductions, discounts can be included to change the payment amount. |

| Date and payer data | N/A | The expiration time (in seconds) is defined by the issuer (valid up to 24 hours by default). Payer data is optional (name and tax ID). | The due date is a fixed day. Payer data is mandatory (name and tax ID). |

| Channel and status | Generated by the client in their own system and the status is always set to active. | The QR code request via API can be changed to avoid payment duplication. If a purchase is cancelled or expired, the client or issuing bank can remove a payment request. | The QR code request via API can be changed to avoid payment duplication. If a purchase is cancelled or expired, the client or issuing bank can remove a payment request. |

| Payment identification | The transaction ID is not unique; there is more than one payment per QR code. | The transaction ID is unique, which can be used for payment reconcilliation. The QR code is unique for each transaction. | The transaction ID is unique, which can be used for payment reconcilliation. The QR code is unique for each transaction. |

| Use cases | Small business, physical stores, P2P transactions etc. | E-commerce and in-store retailers, logistic companies, billers, payment processers etc. | Traditional payment collection for bills that have due dates and can accrue interest. |

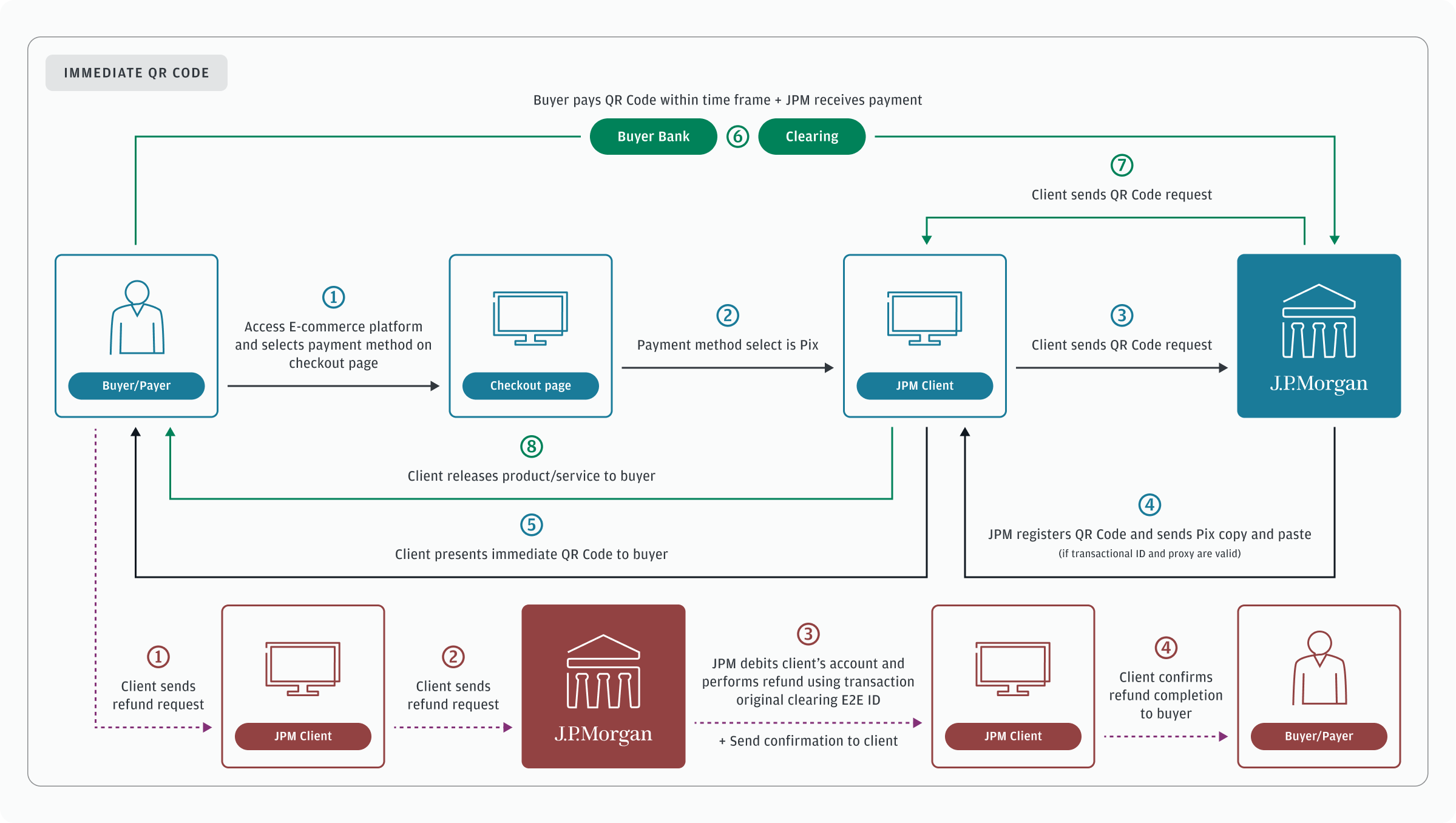

How QR codes work

The following diagram workflow shows how QR codes are used for digital payment:

Next steps

- Learn more about Payment Links and Payment Requests.

- Learn how to create a Payment Request.