Payment Requests

A Payment Request creates a receivable in the form of a QR code, with payment details and a payment link for certain markets. The QR Code or payment link can be presented to payers for payment.

When to use Payment Requests

A Payment Request can be used in the following scenarios:

- Create an immediate or scheduled dynamic QR code for invoice payment for your online business. When a customer checks out, they can select this payment option and receive a QR code for payment. This use case extends beyond e-commerce and can be applied to account top-ups, bill payments, insurance, and other scenarios.

- Create a dynamic QR code with a due date for a bill, such as an energy bill. This QR code can be updated to apply interest or penalties depending on the terms of the invoice. This is applicable for Brazil Pix due-date QR codes.

- Create a static QR code for your ad hoc or occasional payments.

How Payment Requests work

A Payment Request creates a dynamic or static QR code. Each request must have a unique identifier, which will be used throughout the QR code life cycle to link the payment with the Payment Request. This identifier can be assigned by you or J.P. Morgan.

Payment Requests have the following statuses:

| Value | Description |

|---|---|

ACTIVE |

Payment Request captured but not settled |

PROCESSING |

Payment is being processed |

SETTLED |

Payment Request captured and payment settled |

EXPIRED |

Payment Request expired |

CANCELLED |

Payment Request cancelled |

When you create a payment request with a dynamic QR code, you can receive the information needed to generate the QR code image.

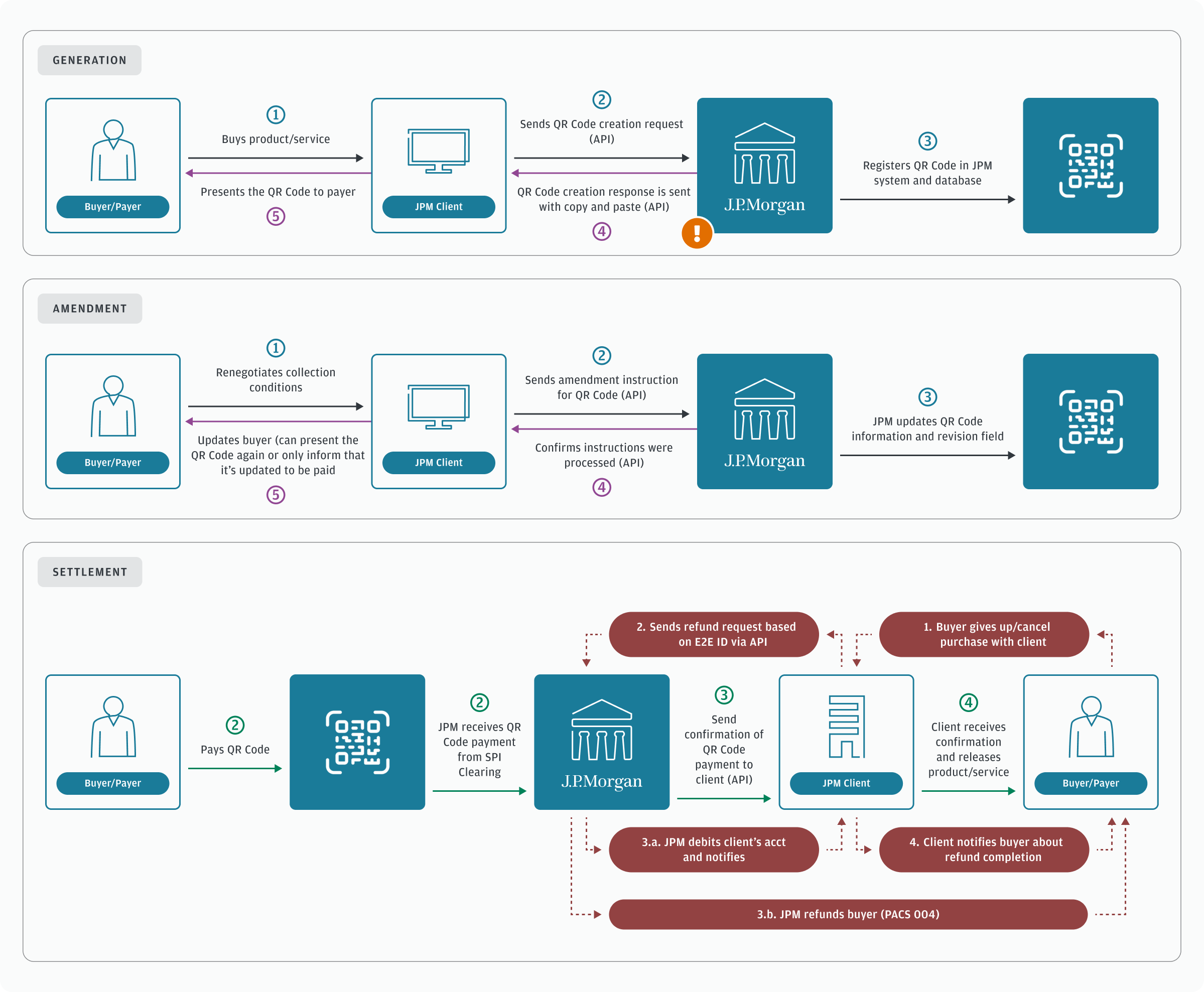

The following diagram shows how payment requests are generated, updated, and reconciled:

Use the Payment returns API to initiate the return of funds. This is currently available in select markets.

Next Steps

Learn how to create a Payment Request.