Kinexys Digital Payments

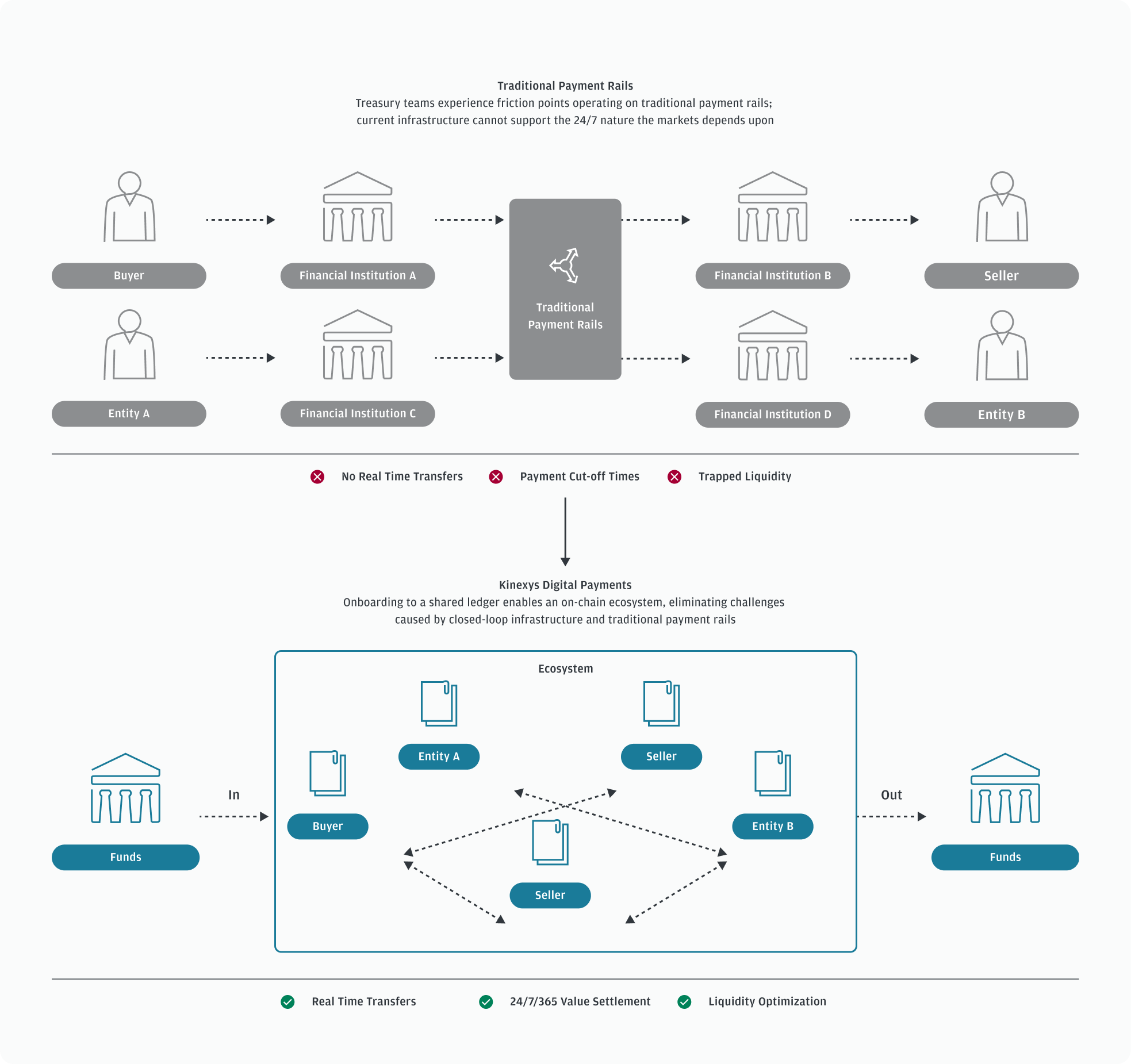

Kinexys Digital Payments is a permissioned blockchain system that serves as a payment rail and deposit account ledger. It allows participating J.P. Morgan clients to transfer funds held on deposit with J.P. Morgan within the Kinexys Digital Payments system.

Kinexys Digital Payments removed traditional treasury friction points, making it ideal for managing real-time liquidity through cross-border payments. It operates beyond currency cut-off times and non-banking hours, including banking holidays and weekends.

Benefits

With Kinexys Digital Payments, you can:

- Avoid prefunding with 24/7 real-time payments: Move funds on banking holidays, fund shortfalls, working capital gaps, and other ad hoc transfers.

- Cross-border payments: Unlock working capital globally with cross-border payments and enable new business models, for example, machine-to-machine payments.

- Real-time visibility: View transactions and balances in real-time to ensure transparency and finality of payment.

- Advance payment type support: Use Delivery versus Payment (DvP), Payment versus Payment (PvP), and machine-to-machine payment types.

Kinexys Digital Payments uses Blockchain Deposit Accounts (BDA), which function similarly to traditional Demand Deposit Accounts (DDA). BDAs facilitate the initiation and real-time settlement of payments. Payments can be made to or from a DDA, Mortgage Servicing Account (MSA), or Client Money Account (CMA) at any funding location listed in the Availability section.

When to use Kinexys Digital Payments

Intra-company payments

Optimize and mobilize your liquidity among connected entities by moving funds domestically or cross-border 24/7/365, including on holidays.

Inter-company payments

Speed up commercial settlement and align treasury processes to the real-time nature of the industry by moving funds domestically or cross-border any day and time of the week including on holidays.

Merchant acquirers and beneficiaries

Pay acquirers 24/7, and settle funds with certainty on-demand, multiple times a day and minimize need for prefunding and credit lines.

Unlock idle working capital and liquidity

Efficiently leverage your existing liquidity by automatically moving funds cross-border in a “follow the sun” model to draw on liquidity as needed.

USD offshore Clearing for financial institutions

Instantaneously settle and clear USD minimizing the need to prefund or use of credit lines on nostro accounts for financial institutions at J.P. Morgan.

Event driven payments

Automated real time treasury through the use of Programmable Payments using an intuitive ‘if-this-then-that’ web interface.

How to use Kinexys Digital Payments

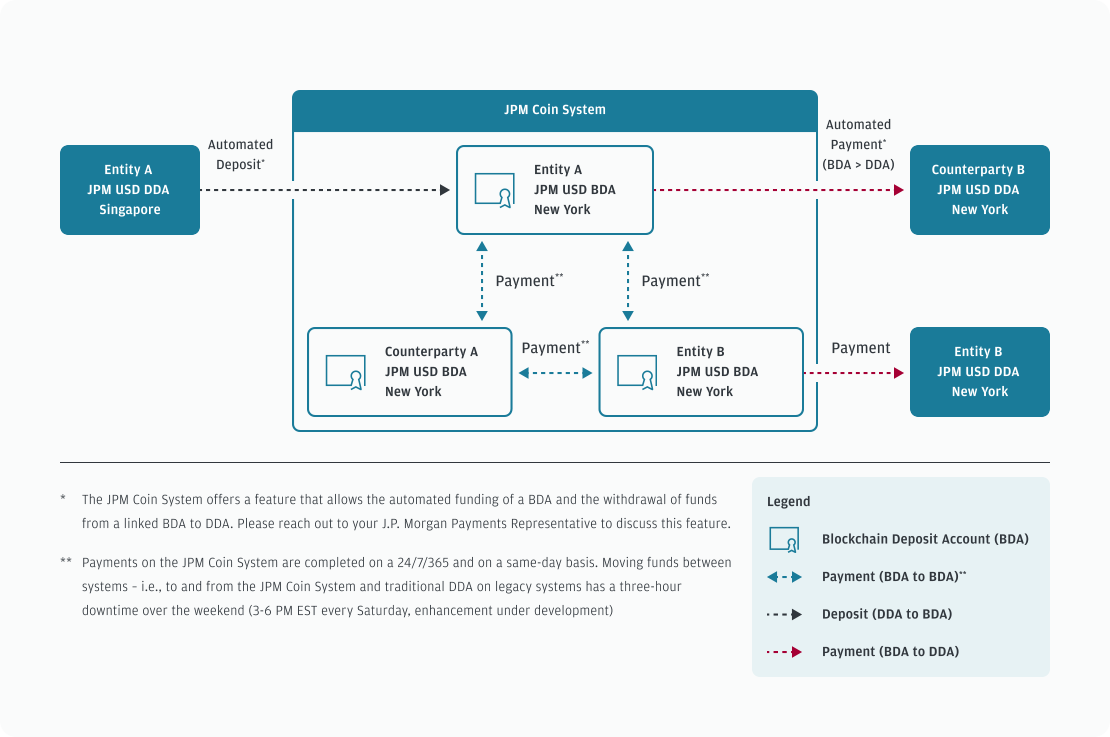

Clients can use Kinexys Digital Payments to settle both domestic and cross-border payments. Kinexys Digital Payments facilitates highly efficient intra-company fund flows (moving liquidity within a group) and inter-company fund flows (transacting with counterparties) through two transaction types:

- Deposit: Customers must first fund their Blockchain Deposit Account (BDA) from a linked Demand Deposit Account (DDA) owned by J.P. Morgan. A linked DDA is an authorized account identified during the Blockchain Deposit Account onboarding process, which is permitted to fund that specific BDA.

- Payment: Customers can initiate payments from their BDA to holders of a BDA or DDA.

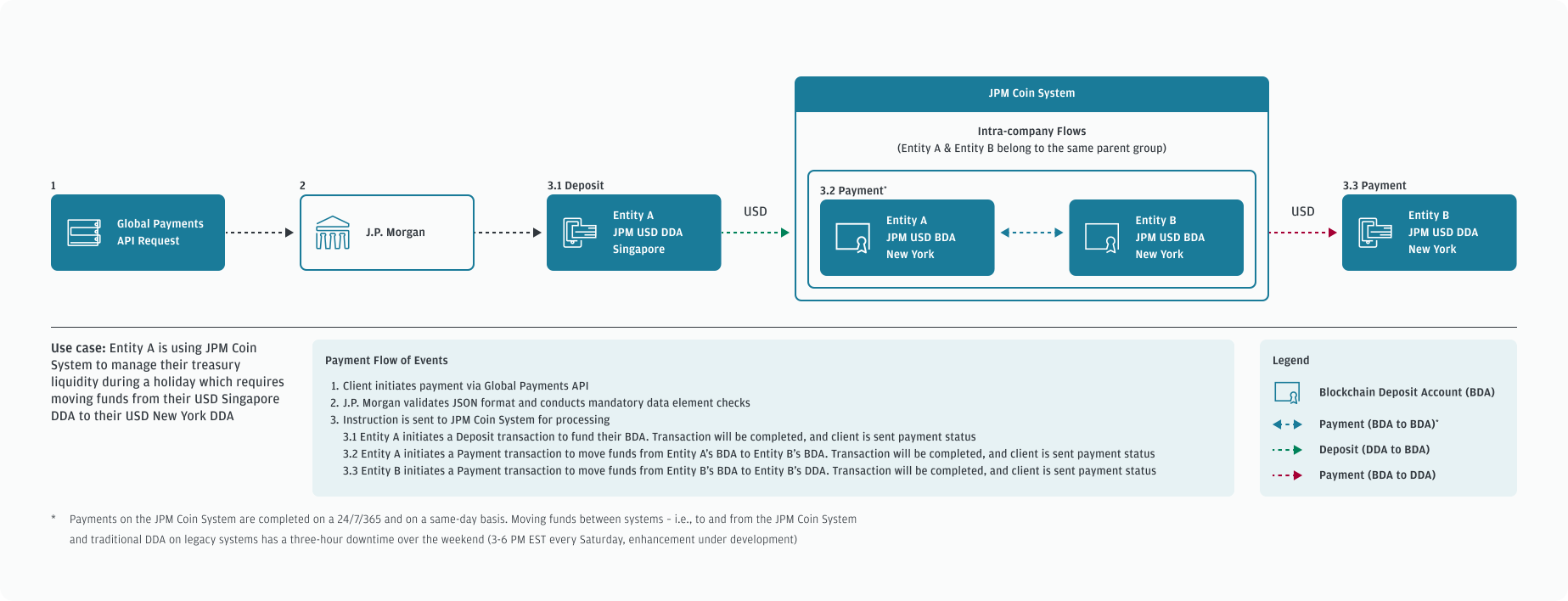

Intra-company fund flow

An intra-company fund flow is a domestic or cross-border payment made between two entities belonging to the same parent group. Kinexys Digital Payments facilitates this intra-company fund flow, which may require each entity to have a Blockchain Deposit Account. The following diagram outlines the end-to-end flow of events for a client seeking to move funds intra-company between Entity A and Entity B.

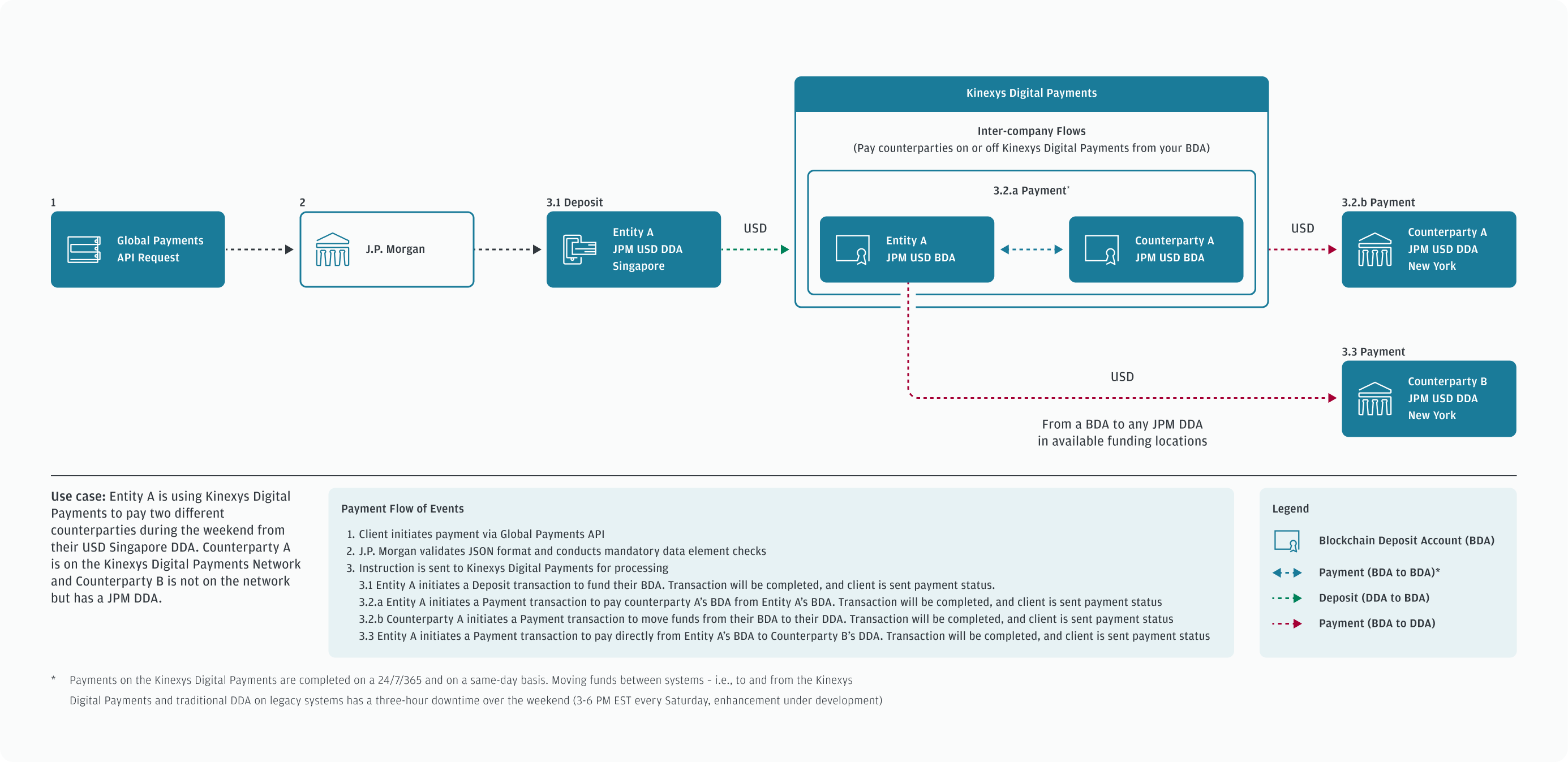

Inter-company fund flow

An inter-company fund flow is a domestic or cross-border payment made between two counterparties. Kinexys Digital Payments facilitates payments between Blockchain Deposit Accounts (BDA) or directly to a Demand Deposit Account (DDA). The following diagram outlines the end-to-end flow of events for a client seeking to pay two counterparties: Counterparty A, who has a J.P. Morgan BDA, and Counterparty B, who has a J.P. Morgan DDA.

Availability

Customers can open a Blockchain Deposit Account (BDA) at J.P. Morgan to support Kinexys Digital Payments to and from the following markets on the Global Payments API:

Regions |

Market/Scheme |

|---|---|

North America (WHEM) |

United States |

Europe, Middle East, and Africa (EMEA) |

|

Asia-Pacific (APAC) |

|

Next steps

- Get started with Kinexys Digital Payments.

- Learn about the required payment parameters for Kinexys Digital Payments.

- Learn how to initiate a Kinexys Digital Payments deposit to fund your BDA.