Interac e-Transfer®

J.P. Morgan Interac e-Transfer® is a 24/7 payment product that lets you to send domestic payments in CAD from your J.P. Morgan account to an eligible beneficiary's email address, Canadian mobile phone number, or a fully formed Canadian bank account using the Interac Network.

Interac is a widely used payment network in Canada, offering directory-like capabilities that enable alias-based and account number-based payments between registered financial institutions participating in the network.

Interac e-Transfer payments are irrevocable.

Benefits

Additional Interac e-Transfer benefits include:

- Alias-based payment: Disburse payments using the recipient's email or mobile phone number.

- Speed: Funds are availabe within minutes.

- Notifications: Receive real-time payment confirmations.

When to use Interac e-Transfer

Insurance claim payouts

Interac e-Transfer is a fast, easy method for insurers who want to offer consumers a seamless way to receive claim payments.

Emergency payroll

Empower employees with on-demand payouts for their earned wages.

Expense reimbursements

Simplify reimbursement to employees for business related expenses.

Vendor payments

Pay vendors for services and goods provided, and reduce costly follow-ups.

Rebates

Fulfill incentives to customers fast and easy.

Contracting services

Pay non-employees fees and commission on-demand.

How Interac e-Transfer works

Payments through Interac e-Transfer can be sent to a beneficiary's email address, Canadian mobile phone number, or fully formed Canadian bank account.

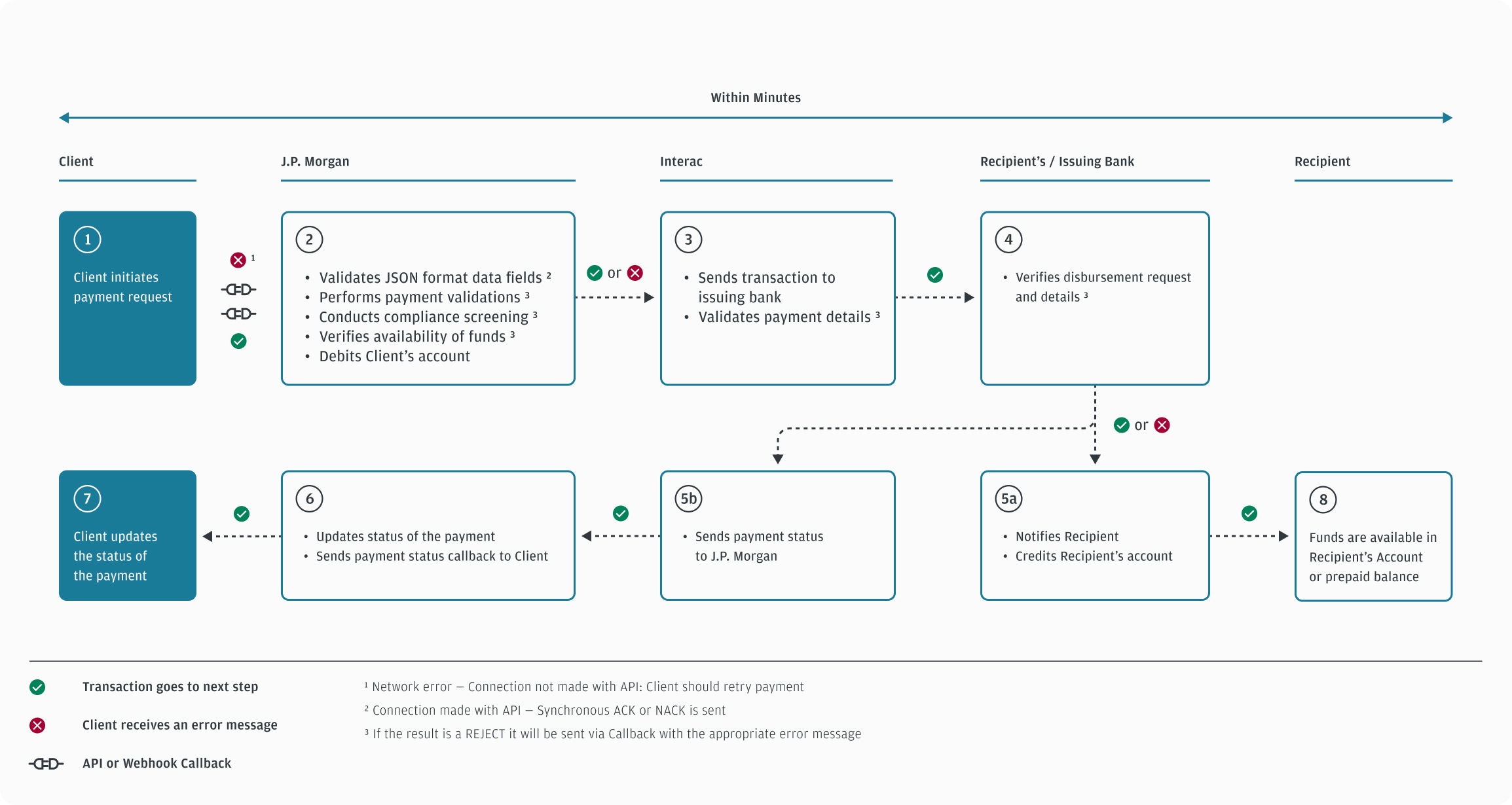

The following diagram depicts the high-level, end-to-end payment flow:

Interac e-Transfer supports payments made by:

- Third-party payment providers

- Money service businesses

- ‘On behalf of’ entities

Settlement

Interac e-Transfer operates on a pre-funding model, requiring adequate funds in the client's account at the time of payment initiation. Temporary holds, such as those placed on funds when an ACH file is submitted, will promptly decrease the amount of funds available for Interac e-Transfer transactions..

The client's account is debited at the time of each payment initiation. If a payment request is rejected, the funds are refunded to the client's account. For rejected transactions, both the debit and credit appear in the bank account statement.

When the receiving beneficiary's financial institution accepts a payment request, it notifies the Interac Network and credits the funds to the beneficiary. Upon receipt of the payment confirmation, J.P. Morgan sends a webhook with a Completed status.

Availability

Interac e-Transfer is available on the Global Payments API in the following regions and markets:

Regions |

Market/scheme |

|---|---|

North America (WHEM) |

Canada |

Related

- Understand payment/creditor options.

- Understand required payment parameters.

- Determine which purpose code is appropriate for your business use cases.

- Be aware of warehoused transactions.

- Learn about creating a security question and response.

Next steps

Learn how to initiate an Interac e-Transfer payment.