Zelle® Disbursements

Zelle® Disbursements is a 24/7 payment rail that lets you quickly send funds from a J.P. Morgan account to a beneficiary's email address or mobile phone number through the Zelle® network.

Benefits

- Speed: Quick availability of funds for beneficiaries.

- Coverage: A large footprint in the United States that includes more than 1,800 banks and most consumer accounts.

- Ease of use: Easy identification of beneficiaries through email addresses and mobile phone numbers rather than lengthy account and routing numbers.

When to use Zelle® Disbursements

Insurance claims

Offer consumers a seamless way to receive claim payments.

Gig worker payments

Pay gig workers instantly without their sensitive banking details.

Airline payments

Make payments to recipients for lost baggage, employee compensation, and more.

How Zelle® Disbursements works

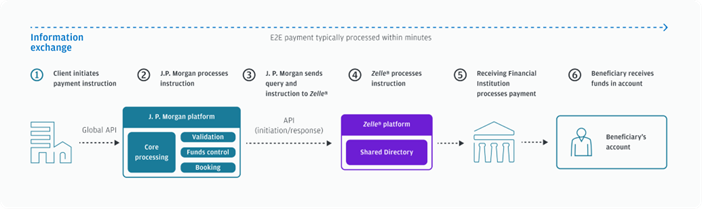

The following image illustrates a high level overview of a typical Zelle® Disbursement:

How Zelle® Disbursements works

The following image illustrates a high-level overview of a typical Zelle® Disbursement:

The process:

- A sender (individual, small business, or corporation) initiates a request to send money to a receiver (individual or small business).

- The sender’s Financial Institution (FI) sends payment information to the Zelle® network.

- The Zelle® network sends a message to the receiver’s FI.

- The receiver’s FI processes the payment to the receiver.

- Funds credited into receiver’s account.

Availability

The following table contains the region and country where Zelle® Disbursements is available for Global Payments API initiation:

Region |

Country |

|---|---|

North America (NA) |

United States |

Next steps

Learn about the payment parameters to initiate Zelle® Disbursements.