Checks API

- Retrieve check status and images quickly and easily

- Issue and cancel checks with accuracy and security

- Strengthen controls to help enhance protection

- Streamline operations to help reduce manual workload

Capabilities

Using J.P. Morgan's Check APIs, you can support efficient check management processes through retrieval, organization, and categorization of check details and images. These capabilities support operational efficiency and informed decision-making.

Check image

Access front and back images of cleared checks to support reconciliation, auditing, and recordkeeping.

Check inquiry

Retrieve status updates and transaction details for issued, canceled, or cleared checks.

Check issuance and cancellation

Support accuracy, security, and control over check transactions

Check stop and revoke

Initiate stop payments or revoke previously authorized transactions to maintain accuracy, security, and control over check payments and approvals.

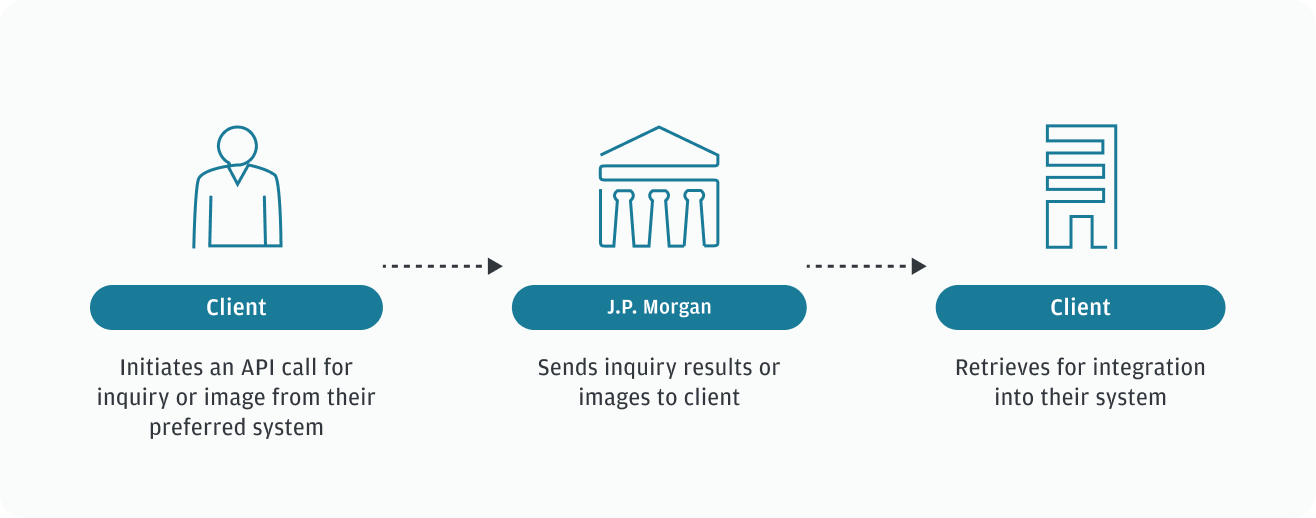

How Checks API works

The Checks API streamlines the entire check lifecycle by providing status tracking, check issuance and cancellation, and image retrieval for verification. It supports efficiency, error reduction, and fraud prevention through secure access, automated notifications, and dashboard management. With these capabilities, businesses gain enhanced visibility and control over check transactions.

The following illustration depicts the high-level end-to-end workflow:

What you can build

With the Checks APIs, you can develop solutions that support efficient check management, business operations, cost management, and fraud risk mitigation for your business and customers.

Custom reporting

Generate tailored reports to fit business needs, run reports on demand, and track report generation status.

Notifications

Receive updates about payment-related events across the check lifecycle.

Enhanced security

Add an extra layer of protection with 3D Secure authentication through a dedicated API request.

Availability

The Checks API is available in the following regions and markets:

Regions |

Market/Scheme |

|---|---|

| North America (NA) |

|

Next steps

Getting startedBeta

Complete the onboarding process to help you get started.

Explore check image

Learn how to effectively manage checks using check image.