Reconcile standard reports

This section shows how to leverage standard reports to reconcile data across payments lifecycle in Commerce Center reporting or download the Standard Reports Reconciliation User Guide.

The following are the reconciliation reports using the standard reports:

- Transaction reconciliation

- Net financial activity reconciliation

- Bank deposit transfer reconciliation

- Merchant fees and adjustment amounts breakdown

Transaction reconciliation

To reconcile transaction level deposit or submission activity, you need to review the Deposit Detail report which provides transaction level details of successfully submitted or deposited transactions.

Follow the steps for transaction reconciliation,

- Find transaction details: Find transactions in the report using Merchant Order Number. Use this report to verify all successful transactions processed against your own internal transactions report.

- Match with net total deposit amount: The summation of the Amount column should match the Net Total Deposit Amount calculated using your Deposit Summary Report (Step 1 of Net financial activity reconciliation) for the same date range.

Net financial activity reconciliation

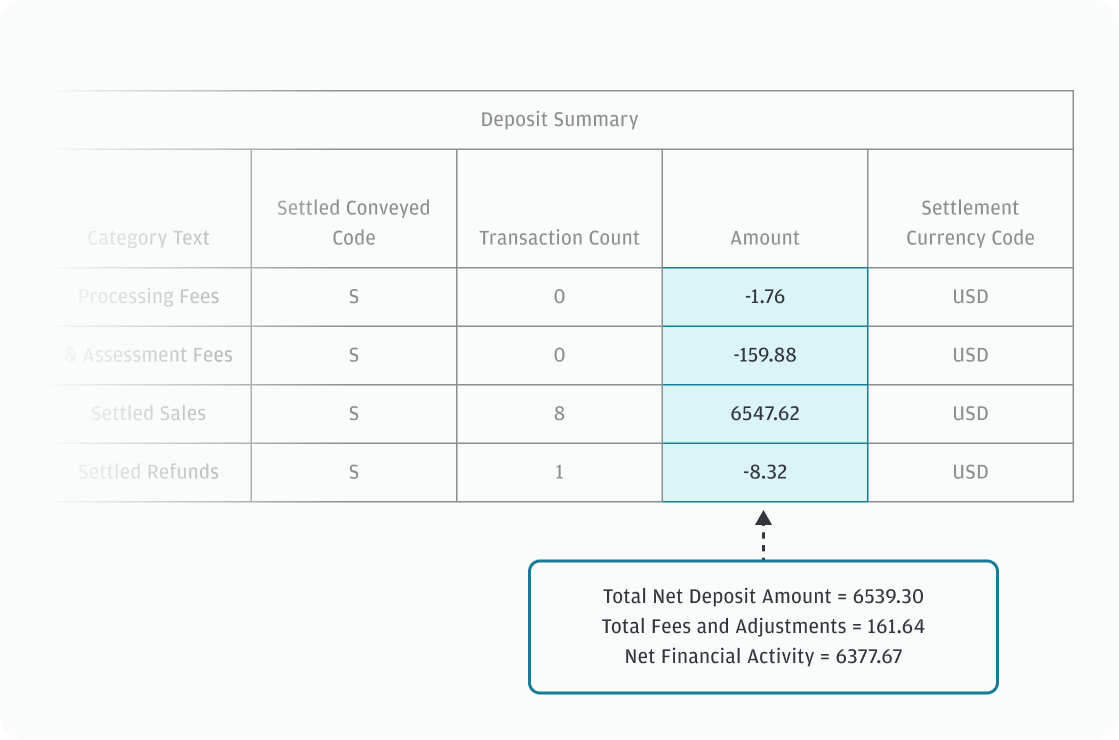

To reconcile total net deposit amount for settled transactions and find total cost of transactions incurred over a reporting period, you need the Deposit Summary report to get a high-level view of your successful deposits/submissions for a date range grouped by fee categories and payment methods.

Follow the steps for net financial activity reconciliation,

- Calculate your Net Total Deposit Amount: Filter the report on column Charge Category Code by SALE and REF values. Sale amount should be a positive value and refund amount should be a negative value. To calculate Net Total Deposit amount , add all the values in the Amount column on the filtered results.

- Calculate your Total Fees and Adjustments Amount: Filter the report on column Charge Category Code by values other than SALE and REF.

- Add Interchange & Assessment Fees (IA) together.

- Add Processing Fees (PFEE) together.

- Add Chargeback adjustments to Fees and Adjustments.

To calculate Total Fees and Adjustments Amount, add all the values in the Amount column on the filtered results. Total Fees provides insight of cost of transactions for that day, week, and month.

- Calculate your Net Financial Activity: Net Financial Activity = Net Total Deposit Amount – Total Fees & Adjustments Amount.

Deducting Total Fees and Adjustments from the Net Total Deposits gives you the Net Financial Activity which identifies your deposit into your bank account.

In the following example with select columns from the Deposit Summary report, the Total Net Deposit Amount, Total Fees and Adjustments and Net Financial Activity calculation is represented.

Bank deposit transfer reconciliation

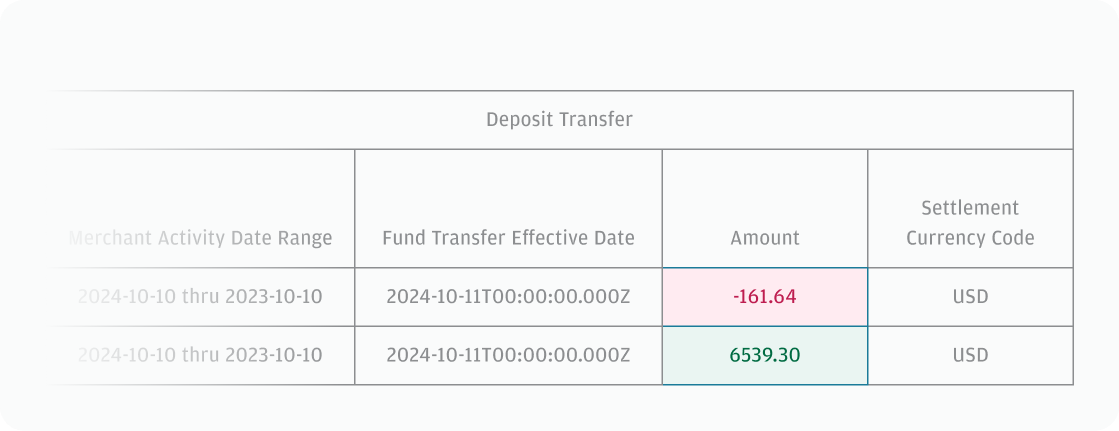

To reconcile your bank accounts by comparing bank statements and the net financial activity, you need the Deposit Transfer report which summarizes the fund transfers that have been created and are pending, on-hold, rejected or scheduled for credit to your bank account during the reporting period.

Follow the steps for bank deposit transfer reconciliation,

- Calculate your Fund Transfer Amount: Filter the report on Funds Transfer Category Description column by Pending Funds Transfer and Merchant Activity Date Range. Select the date that matches your date range from your Deposit Summary Report. To calculate Total Fund Transfer Amount , add all the values of the Amount column on the filtered results.

- Match it with your Net Financial Activity amount: Total fund transfer amount should match the Net Financial Activity amount calculated using your Deposit Summary Report (Step 3 of Net financial activity reconciliation) for the same date range.

In the following example with select columns from the Deposit Transfer report, the credit and debit into the bank account are represented.

Merchant fees and adjustment amounts breakdown

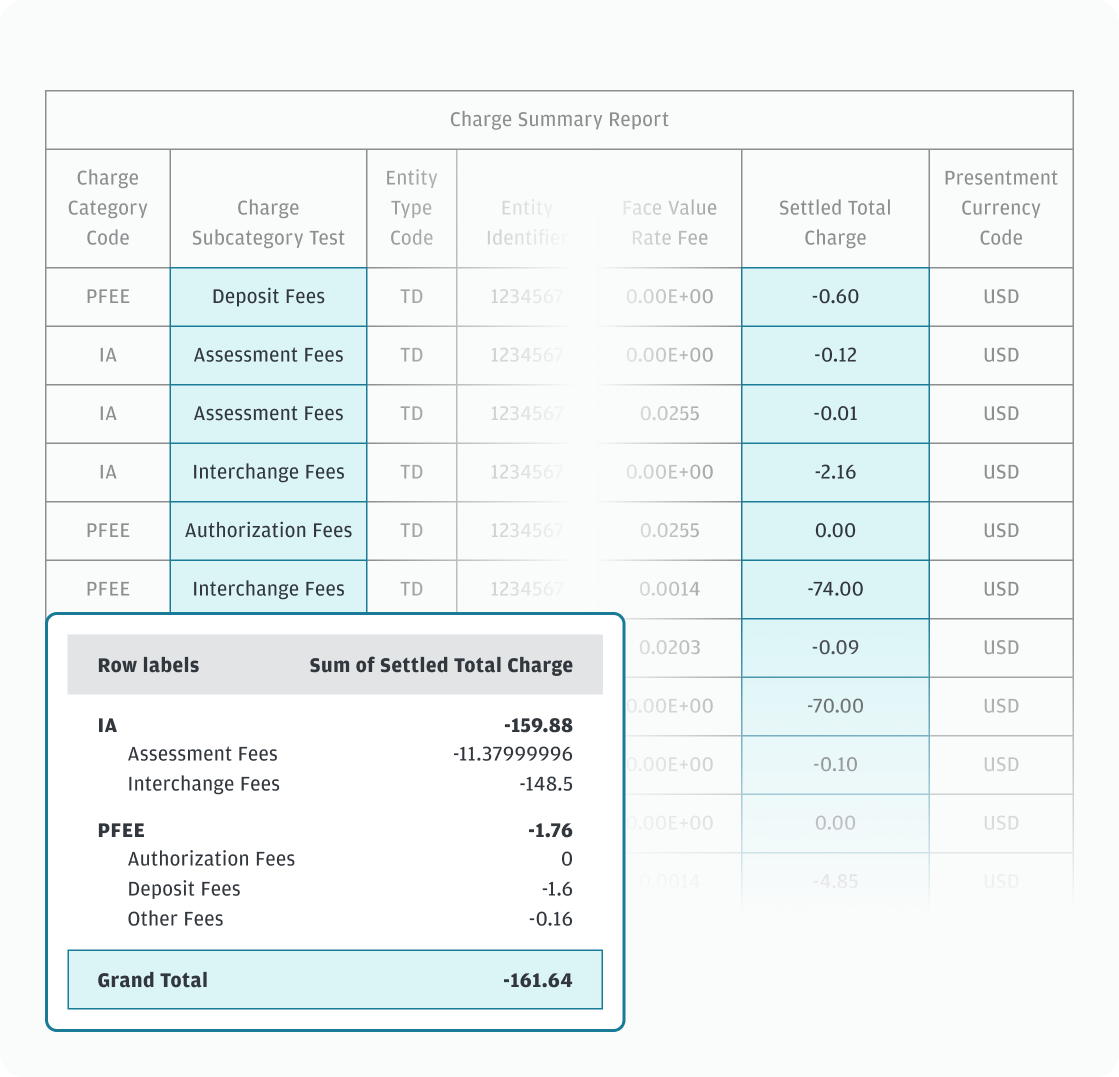

To find granular breakdown of the merchant fees by interchange, assessment, and processing fees assessed during a specified reporting period, you need the Charge Summary Report which identifies fees assessed for services that are posted during the reporting period.

Follow the steps for merchant fees and adjustment amounts breakdown,

- Find Fees breakdown: Pivot on columns Charge Category Code, Charge Subcategory and then select Settled Total Charges column to sum the values. This gives you the granular breakdown of the fees in each category.

- Match with Total Fees and Adjustments Amount: The summation of the values matches the Total Fees and Adjustment Amount calculated using your Deposit Summary Report (Step 2 of Net financial activity reconciliation) for the same date range.

In the following example with select columns from the Charge Summary report, the fees breakdown is represented.