Online Payments

- Process card, wallet, local, and alternative methods of payment

- Store or set up recurring payments

- Protect payment information with encryption and fraud tools

- Easily manage consumer profiles

Availability

Online Payments API is currently available in:

- Australia

- Canada

- Europe

- United Kingdom

- United States

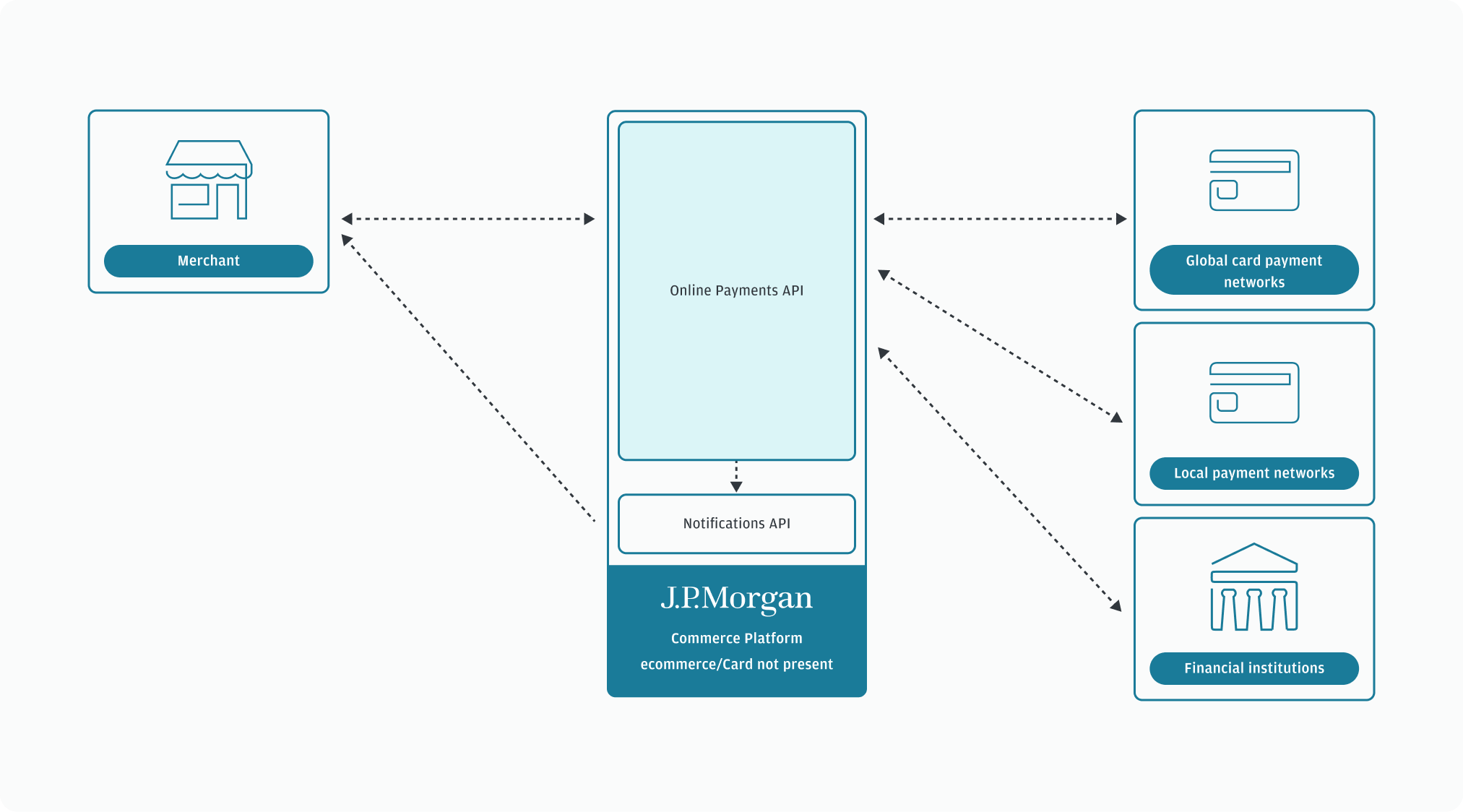

How Online Payments works

Here is how the Online Payments API works:

- We receive your Online Payments API requests and, depending on the method of payment and type of request, take action.

- Global card requests: We interact with the global payment networks and provide you with immediate, real-time results.

- Local payment methods: We provide you with immediate confirmation of interaction with the local payment networks.

- Financial institution direct debits: We provide you with immediate confirmation of interaction with the financial institutions.

- We record and store all activity/events for notifications and reporting purposes.

- You determine the events you want to receive notifications for, when they occur. Refer to the Notifications API for more details.

- We send you webhook notifications advising you of the activity.

- The notifications contain identifiers you use to retrieve event-specific details.

Benefits of Online Payments

3-D Secure

Reduce fraud risk through cardholder identification verification.

Consumer Profile Management

Create, update, and store customer profiles.

Direct Pay

Enhance Visa and Mastercard transactions with real-time payment processing.

Encryption

Protect sensitive cardholder information.

Fraud Prevention

Prevent fraudulent transactions through fraud analysis requests.

Merchant Selectable ResponsesComing Soon

Streamline authorization reversals for fraudulent transaction intervention.

Real-time account updater

Update Visa card account information on the spot.

Recurring payments

Easily set up recurring payments.

Stored Payments

Enable cardholder-initiated stored payments.

Tokenization

Secure card data in transit with tokenization solutions.

API functionality

API identifiers

The following key identifiers are essential to payment processing using the Online Payments API. They are used to uniquely identify transaction details, link multiple captures to a single authorization, and retrieve payment transaction details.

| Value | Description | Assigned by |

|---|---|---|

transactionId |

Identifies a payment from, or a refund to, a consumer. As there may be multiple requests to complete a transaction, a unique transactionId is assigned by J.P. Morgan and provided for each response. Use this ID to identify and perform subsequent actions, such as capturing, updating, or voiding the transaction. |

Online Payments |

authorizationId |

Identifies an authorization request. A payment request may have multiple authorization IDs, as in the case of a reauthorization of an expired authorization. | Online Payments |

captureId |

Identifies a capture request. A payment request may have multiple capture IDs for the same authorization, as in the case of separate captures for a split shipment order. | Online Payments |

refundId |

Identifies a refund request. A payment request may have multiple refund IDs associated with separate refund requests for the same payment request. | Online Payments |

paymentRequestId |

A paymentRequestId (generated on the original authorization) identifies the intent to collect a payment. A payment request may have multiple transactions associated because its lifecycle consists of several phases. These phases include various authorizations, captures, and, potentially, multiple refunds. |

Online Payments |

requestId |

Each message sent via an API is a request and should include a unique requestId to detect duplicate requests. In the event your system does not receive a response due to a timeout or an exception case, you can attempt to retry the request. To do so, re-send the message using the same requestId, as this allows us to ensure the message is not processed multiple times. If the original request is processed, the original response message content is returned. |

Merchant |

merchantOrderNumber |

A For Canada, EU, UK, and US implementations, the following applies:

|

Merchant |

networkTransactionId |

Unique transaction ID assigned by the payment network. | Payment brands |

Callbacks/notifications

Understanding webhooks and callbacks is essential for the Online Payments API. For more information, refer to the Notifications API.

Duplicate logic

J.P. Morgan performs a duplicate check on every transaction. A duplicate request is identified when J.P. Morgan receives a non-unique requestId and changes were made to any of the following fields:

- amount

- accountNumber

- accountHolderName

- verificationValue

- billingAddressLine1

- billingAddressLine2

- billingAddressCity

- billingAddressState

- billingAddressCountry

- billingAddressPostalCode

If changes were made to any of the previously listed fields, a 409 response code is returned, along with the following response:

{

"responseStatus": "ERROR"

"responseCode": "DUPLICATE"

"responseMessage": "Duplicate Transaction"

} If the previously listed fields are unchanged but the same requestId is used, a 200 response code is returned along with the following response:

information":{

"code": "duplicateRequest",

"message": "This is a duplicate request."

}