Initiate a payment

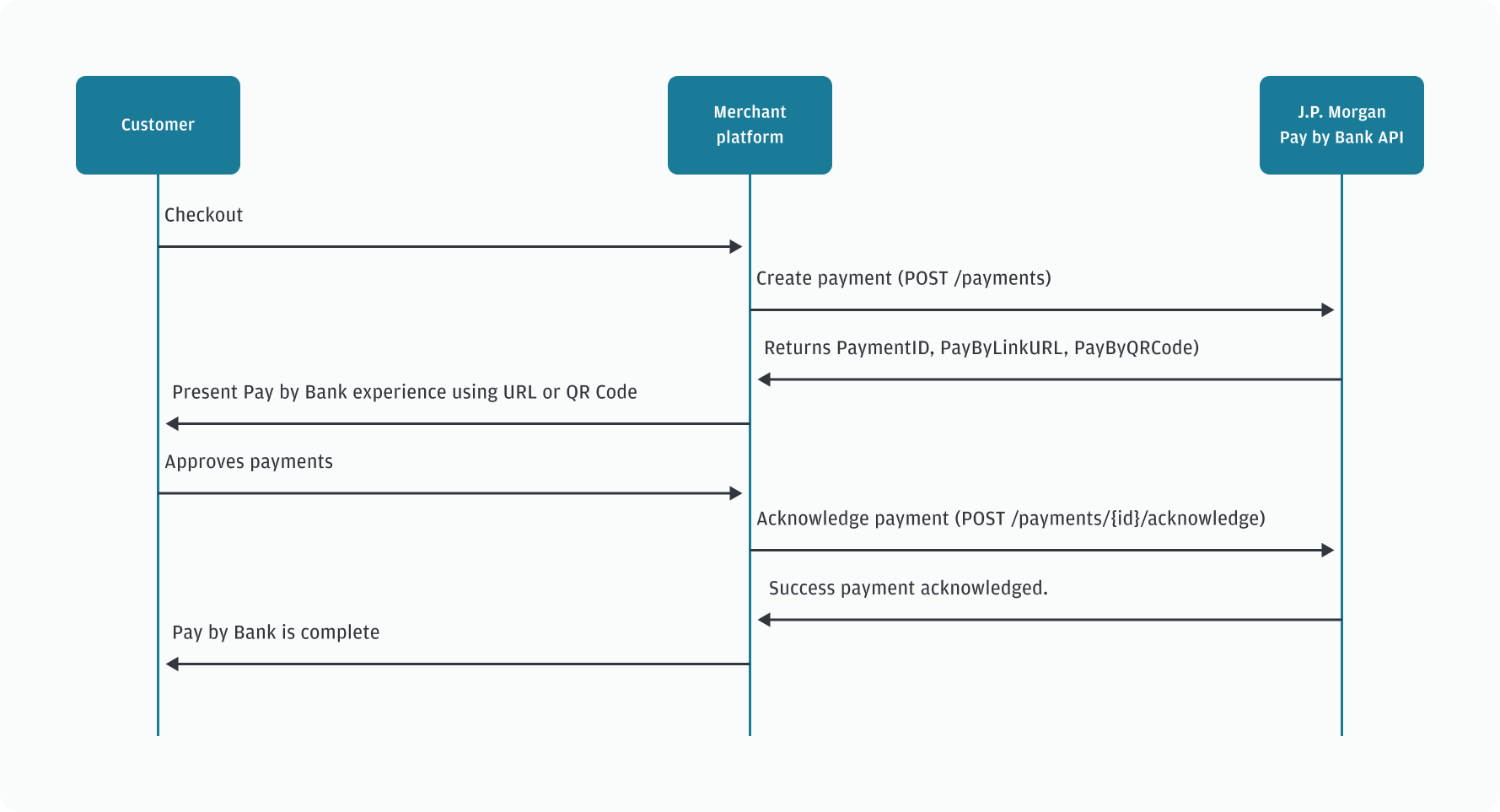

You can build the Pay by Bank payment experience into your existing checkout flow. For a complete payment experience, the user flow runs in the following order:

- Your customer selects Pay by Bank as a payment option.

- You initiate the payment using

POST /payments. - The

POSTrequest returns an ID and a link, which you display to your customer. You can also use the link to automatically open the Pay by Bank screens. - Your customer gives their permission through the website flow. There are no additional API calls to make during this process, the UX guides the customer through the payment process.

- Once payment is complete, your customer is able to return to your checkout screens.

- Using the ID returned in the original request, send a request to

POST payments/{id}/acknowledge - Display the payment acknowledgement details to your customer.

- Retrieve payments with

GET /payments/{id}

Initiate a payment

To initiate a payment, send a POST /payments request and you must include the following information:

| Field Name | Description |

|---|---|

debtor |

Name of the party making the payment. |

market |

IISO code for the market where the payment is being made. |

creditor |

Party receiving the payment, including name, account details, and type. |

reference |

Your unique ID for the payment. |

paymentAmmount |

Amount being paid and the currency. |

paymentType |

Type of payment being made. This can be RTP, LOW_VALUE_RETAIL or HIGH_VALUE_BUSINESS. |

curl --request POST \

--url https://api-mock.payments.jpmorgan.com/tsapi/pay-by-bank/v2/payments \

--header 'Accept: application/json' \

--header 'Content-Type: application/json' \

--header 'Idempotency-Key: ' \

--data '{

"debtor": {

"name": "Bala Thandapani"

},

"market": "GB",

"creditor": {

"name": "Newgen Media LLC",

"account": {

"accountId": "06090887654321",

"accountIdType": "SORT_CODE"

}

},

"reference": "subscription - #78004300",

"paymentType": "RTP",

"redirectURL": "https://api.newgenmediacorp.co.uk/pay-by-bank/callback",

"paymentAmount": {

"value": "100.00",

"currency": "GBP"

}

}'{

"id": "1b036f9c-8c84-4ce6-b1dd-5979472945a1",

"debtor": {

"name": "Bala Thandapani"

},

"market": "GB",

"status": "NONE",

"creditor": {

"name": "Newgen Media LLC",

"account": {

"accountId": "11223387654321",

"accountIdType": "SORT_CODE"

}

},

"createdAt": "2023-08-20T13:31:25Z",

"reference": "subscription - #78004300",

"paymentType": "RTP",

"redirectURL": "https://api.newgenmediacorp.co.uk/pay-by-bank/callback",

"paymentAmount": {

"value": "100.00",

"currency": "GBP"

},

"paymentQRCode": "https://images.newgenmediacorp.co.uk/image/1b036f9c-8c84-4ce6-b1dd-5979472945a1",

"paymentLinkURL": "https://payments-link.jpmorgan.com/1.0/pay/direct?client_id=9cd2e1c9527e4e18ad4756393e09cb2c&redirect_uri=https://api.newgenmediacorp.co.uk/pay-by-bank/callback&market=DE&payment_request_id=1b036f9c-8c84-4ce6-b1dd-5979472945a1",

"statusUpdatedAt": "2023-08-20T13:31:25Z"

}Display the payment flow

In the POST /payments 200 response, you can see the values for the QR code and payment link that should be made available in the payment experience:

paymentQRCodepaymentLinkURL

Use the link in paymentLinkURL to open a browser frame to the payment session. This can be customer activated or opened automatically when you get the successful response to your POST request.

If the payment is being made on a desktop or any device other than a mobile device, you can display the QR code using the link provided in paymentQRCode.

Keep the window open while your customer is guided through the process.

Acknowledge payment

Once the payment flow is completed, your browser frame should close and your customer should return to your payment experience. You can now confirm that the payment has been made using POST /payments/{id}/acknowledge.

curl --request POST \

--url https://api-mock.payments.jpmorgan.com/tsapi/pay-by-bank/v2/payments/id/acknowledge \

--header 'Accept: application/json' \

--header 'Content-Type: application/json'{

"id": "1b036f9c-8c84-4ce6-b1dd-5979472945a1",

"debtor": {

"name": "Bala Thandapani",

"account": {

"accountId": "06080912311871",

"accountIdType": "SORT_CODE"

}

},

"market": "GB",

"status": "SENT",

"creditor": {

"name": "Newgen Media LLC",

"account": {

"accountId": "11223387654321",

"accountIdType": "SORT_CODE"

}

},

"createdAt": "2023-08-20T13:31:25Z",

"reference": "subscription - #78004300",

"paymentType": "RTP",

"redirectURL": "https://api.newgenmediacorp.co.uk/pay-by-bank/callback",

"acknowledged": "ACKNOWLEDGED",

"paymentAmount": {

"value": "100.00",

"currency": "GBP"

},

"paymentQRCode": "https://images.newgenmediacorp.co.uk/image/1b036f9c-8c84-4ce6-b1dd-5979472945a1",

"paymentLinkURL": "https://payments-link.jpmorgan.com/1.0/pay/direct?client_id=9cd2e1c9527e4e18ad4756393e09cb2c&redirect_uri=https://api.newgenmediacorp.co.uk/pay-by-bank/callback&market=DE&payment_request_id=1b036f9c-8c84-4ce6-b1dd-5979472945a1",

"statusUpdatedAt": "2023-08-20T13:31:25Z"

}In this response, you can see that the payment request has a status of SENT and and acknowledged value of ACKNOWLEDGED.

From your customer's perspective, this means the payment has been accepted and they can continue to the next phase of your checkout process.

Get details of a payment

You can request details of any payment using the paymentId in a request to GET /payments/{id}.

curl --request GET \

--url https://api-mock.payments.jpmorgan.com/tsapi/pay-by-bank/v2/payments/id \

--header 'Accept: application/json'{

"id": "1b036f9c-8c84-4ce6-b1dd-5979472945a1",

"debtor": {

"name": "Bala Thandapani",

"account": {

"accountId": "06080912311871",

"accountIdType": "SORT_CODE"

}

},

"market": "GB",

"status": "SENT",

"creditor": {

"name": "Newgen Media LLC",

"account": {

"accountId": "11223387654321",

"accountIdType": "SORT_CODE"

}

},

"createdAt": "2023-08-20T13:31:25Z",

"reference": "subscription - #78004300",

"paymentType": "RTP",

"redirectURL": "https://api.newgenmediacorp.co.uk/pay-by-bank/callback",

"acknowledged": "ACKNOWLEDGED",

"paymentAmount": {

"value": "100.00",

"currency": "GBP"

},

"paymentQRCode": "https://images.newgenmediacorp.co.uk/image/1b036f9c-8c84-4ce6-b1dd-5979472945a1",

"paymentLinkURL": "https://payments-link.jpmorgan.com/1.0/pay/direct?client_id=9cd2e1c9527e4e18ad4756393e09cb2c&redirect_uri=https://api.newgenmediacorp.co.uk/pay-by-bank/callback&market=DE&payment_request_id=1b036f9c-8c84-4ce6-b1dd-5979472945a1",

"statusUpdatedAt": "2023-08-20T13:31:25Z"

}Reference

The following data fields are returned in the response to successful POST /payments and GET /payments/{id} requests:

| Field Name | Description |

|---|---|

value |

The value representation of a monetary amount. The value should be more than 0.01 with maximum of two decimal places allowed |

currency |

ISO 4217 Alpha-3 Currency Code |

paymentType |

The type of payment |

market |

ISO 3166-1 alpha-2 country code for the market where the payment is initiated |

redirectURL |

An optional re-direct URL of the merchant where the end-user will be redirected to once they have successfully authorized the payment with their bank or financial institution. |

name |

Name of the debtor |

accountId |

Debtor account number as identified by the bank or financial institution |

accountIdType |

The account identifier type |

name |

Name of the creditor |

accountId |

Creditor account number as identified by the bank or financial institution |

accountIdType |

The account identifier type |

reference |

A free text field that can be used to provide a meaningful reference for a payment transaction |

id |

A unique identifier of the payment |

status |

The status of the submitted payment request |

statusUpdatedAt |

The last updated date and time of the payment status in ISO 8601 format |

statusMessage |

A textual description of the status |

createdAt |

Indicates when the Payment request was created in the system. Follows ISO date time format |

paymentLinkURL |

An HTTPS URL to make the payment |

paymentQRCode |

An HTTPS URL to download the QR code image to make the payment |

acknowledged |

Indicates whether the payment has been acknowledged or not by the API caller |

providerName |

Pre-filled provider (FInancial Institution) name which triggers the skipping of the Bank selection experience |

Sequence diagram of API requests for payment initiation