Real-Time Payments

Real-Time Payments (RTP) is a payment rail that lets you send and receive money instantly. With RTP, funds are available right away, settlements are final, and you get instant confirmation, all in just a few seconds. This means your payments are both initiated and settled immediately.

Benefits

Experience the benefits of RTP across the payment lifecycle.

Onboarding

Easily enter new markets with our Global API and improved API-based experience, offering around the clock availability in most regions.

Payment processing

Boost your disbursement success rate and seamlessly handle high-volume transactions.

Settlement

Instant payment finality and visibility with real-time view of cash positions and confirmations.

Business operations

Automatic reconciliations & improved liquidity management.

RTPs are immediate, irrevocable, contextual, and secure. Additional benefits include:

- No cutoff times: Instant payments are available around the clock*.

- Speed and transparency: Funds are available to the payee within seconds and ready for immediate use.

- Finality: Transactions are irrevocable.

- Messaging: Extensible messaging supports more sophisticated applications, such as confirmation notifications/callbacks.

When to use Real-Time Payments

Wallet withdrawals

Give users immediate access to funds by initiating transfers from digital wallets to bank accounts.

Instant payroll

Empower employees with on-demand payouts for their earned wages.

Merchant payouts

Give merchants the flexibility to access their funds on demand.

Vendor payments

Pay vendors for services and goods provided and reduce costly follow-ups.

Urgent payments and payroll

Make urgent payments to employees with speed and finality.

Bill payments

Confirm received payments in real-time, reducing support calls.

How Real-Time Payments works

RTPs let you transfer money between two bank accounts or aliases, such as an email address or mobile number, and everything happens within seconds. You can make RTPs any time, day or night, weekends, and even holidays.

Whether it’s a business sending money across borders, a worker transferring remittances at home, or shoppers making instant purchases online, more and more people are looking for the speed and convenience that RTP offers.

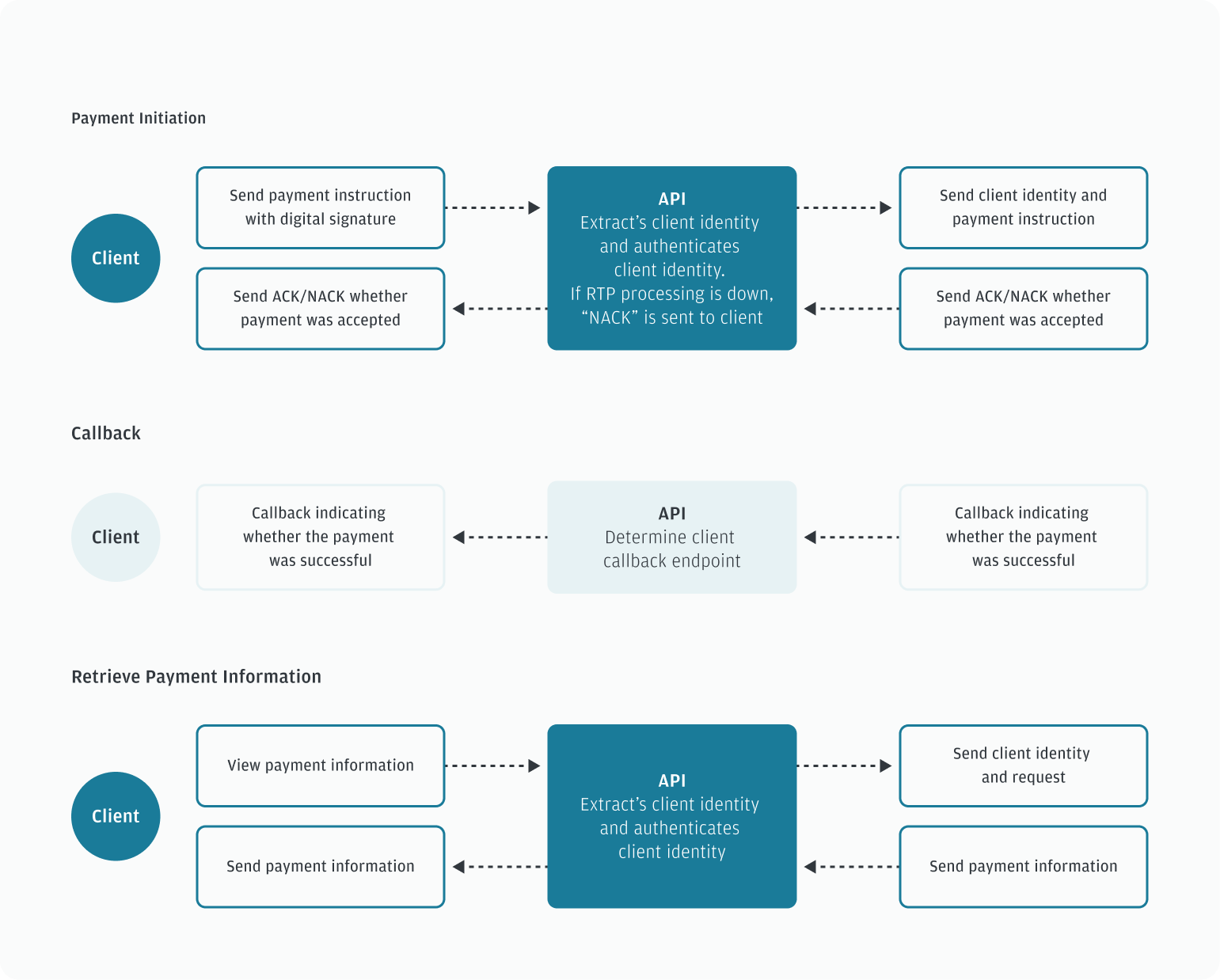

The Global Payments API supports three key RTP actions:

- Initiate a payment: Submit a payment request by submitting the minimum required payload for your region to the Global Payments

/paymentsendpoint. - Determine success of the payment: Enable webhooks for automatic status updates, or manually check the status of your payment request.

- Retrieve payment information: Use the contents of a successful payment response to retrieve the payment information from your request.

Availability

RTP is available in the following regions and markets:

| Regions | Market/Scheme |

|---|---|

| North America (WHEM) | United States

|

| Europe, Middle East, and Africa (EMEA) |

|

| Asia-Pacific (APAC) |

|

| Latin America (LATAM) |

|

Next steps

- Learn how to initiate a RTP request.

- Understand the required payment parameters for your region.