Push to Wallet

Push to Wallet is a 24/7 payment rail that enables you to send payments to registered PayPal or Venmo users. PayPal notifies recipients when the money is available in their wallet.

Push to Wallet payments are irrevocable.

Benefits

Additional Push to Wallet benefits include:

- Reach: Access a network with millions of external wallet users, including recipients without bank accounts or who prefer alternate payment methods.

- Speed: Funds are quickly available to recipients.

- Ease of use: There is no need to capture bank account or routing numbers as you can use alias-based information, such as a mobile number or email address, to identify the recipient of the payment.

When to use Push to Wallet

Insurance

Push to Wallet is a fast, easy method for insurers that want to offer consumers a seamless way to receive claim payouts.

Gig economy services

Push to Wallet can be used to pay out wages for short-term engagements, temporary contracts and independent contracting.

Telecom companies

Push to Wallet is a fast, easy method for telecom companies to pay out loyalty payments, promotions, refunds or carrier-switching rebates.

Rebates

Easily and quickly initiate rebates to customers.

Airlines

Make payments to recipients for lost baggage, employee compensation and more.

How Push to Wallet works

Payments via the Push to Wallet network can be sent to a beneficiary’s registered email or phone number used in a PayPal or Venmo wallet.

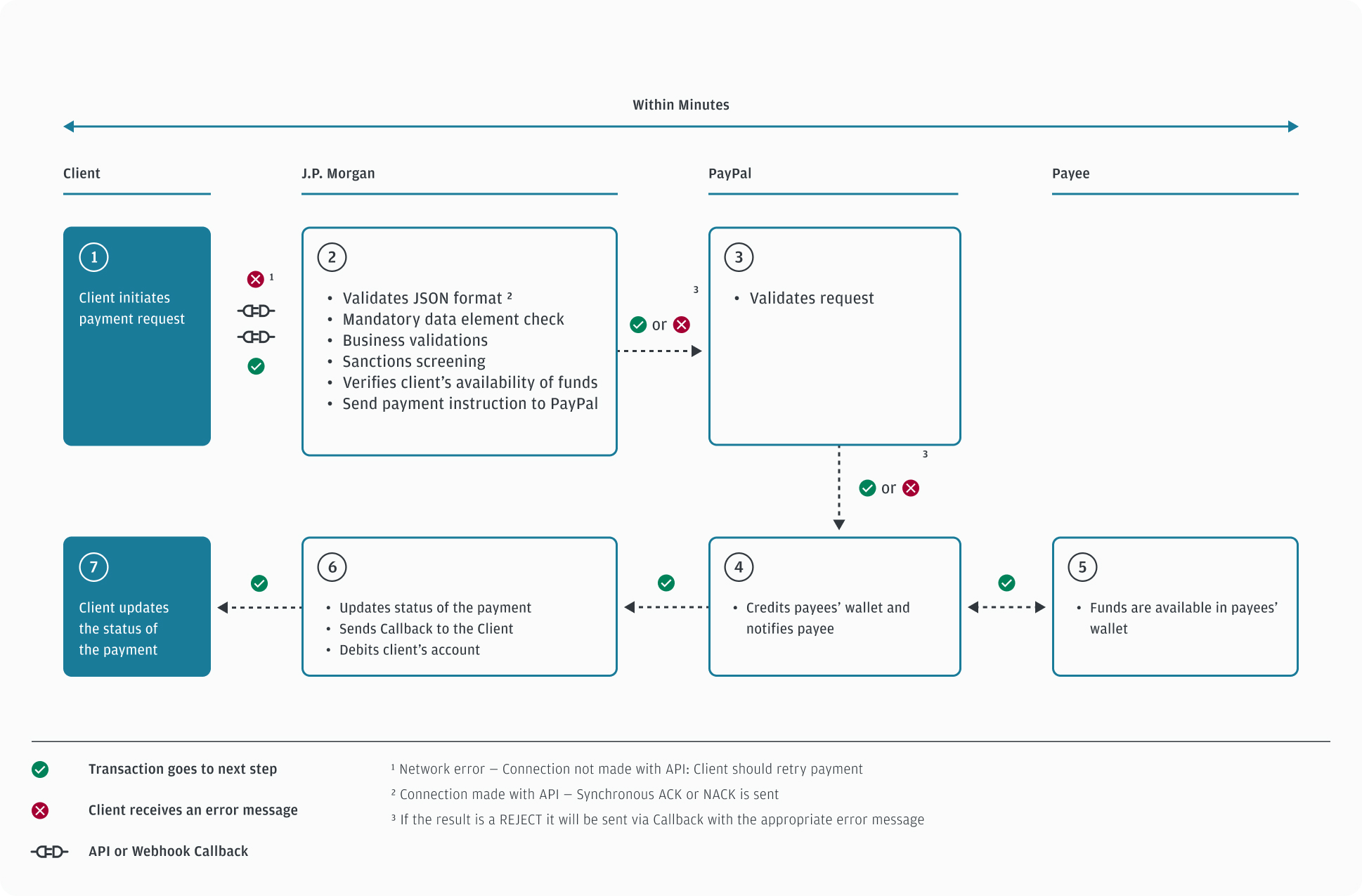

The following diagram depicts the high-level, end-to-end payment flow:

Settlement

Push to Wallet operates on a pre-funding model. Adequate funds must be available in your account at the time of payment initiation. Please be aware that any temporary holds, such as a hold placed on funds when an ACH file is submitted, will immediately reduce the amount of funds available for Push to Wallet transaction processing.

Availability

Push to Wallet is available on the Global Payments API in the following regions and markets:

| Regions | Market/scheme |

|---|---|

| North America (NA) | United States |

Related

- Understand payment/creditor options.

- Understand required payment parameters.

- Determine which Purpose code is appropriate for your business use cases.

- Be aware of warehoused transactions.

Next steps

Learn how to initiate a Push to Wallet payment.