Push to Card

J.P. Morgan Push to Card (P2C) is a 24/7 payment rail that allows you to send funds directly to an eligible recipient’s debit or reloadable prepaid Visa or Mastercard. Recipients can access the funds in near real-time, with a network maximum time of 30 minutes. Push to Card allows a funds disbursement of up to $125,000 per transaction. For money transfer use cases, the threshold limit is $50,000 per transaction.

Benefits

Additional Push to Card benefits include:

- Coverage: This payment method provides extensive reach for consumers with a Visa or Mastercard-branded debit or reloadable prepaid card.

- Ease of Use: You can use the 16-digit debit card number and expiration date from your digital or physical wallet, eliminating the need to search for bank account or routing numbers.

- Speed: Funds become available in near-real time, typically within about 30 seconds, with a network service level agreement (SLA) of 30 minutes.

- J.P. Morgan differentiator: Clients can fund and reconcile transactions from the same accounts used for other payment types, streamlining the process.

When to use Push to Card

Push to Card supports a wide range of payment brand-approved use cases for both Business to Consumer (B2C) and Business to Business (B2B) transactions. Some examples include:

Insurance claims

Push to Card is a fast, easy method for insurers that want to offer consumers a seamless way to receive claim payments.

Gig economy services

Ride share companies can use Push to Card as point of differentiation to attract and retain workers.

Telecom companies

Push to Card is a fast, easy method for telecoms that want to offer consumers financial incentives to switch from a competitor.

Government disbursements

Merchants can use Push to Card to disburse government payments including social security payments, unemployment, disability, and more.

Marketplace payouts

Marketplaces can use Push to Card as an easy method for sellers to receive funds.

Airline payments

Make payments to recipients for lost baggage, employee compensation and more.

How Push to Card works

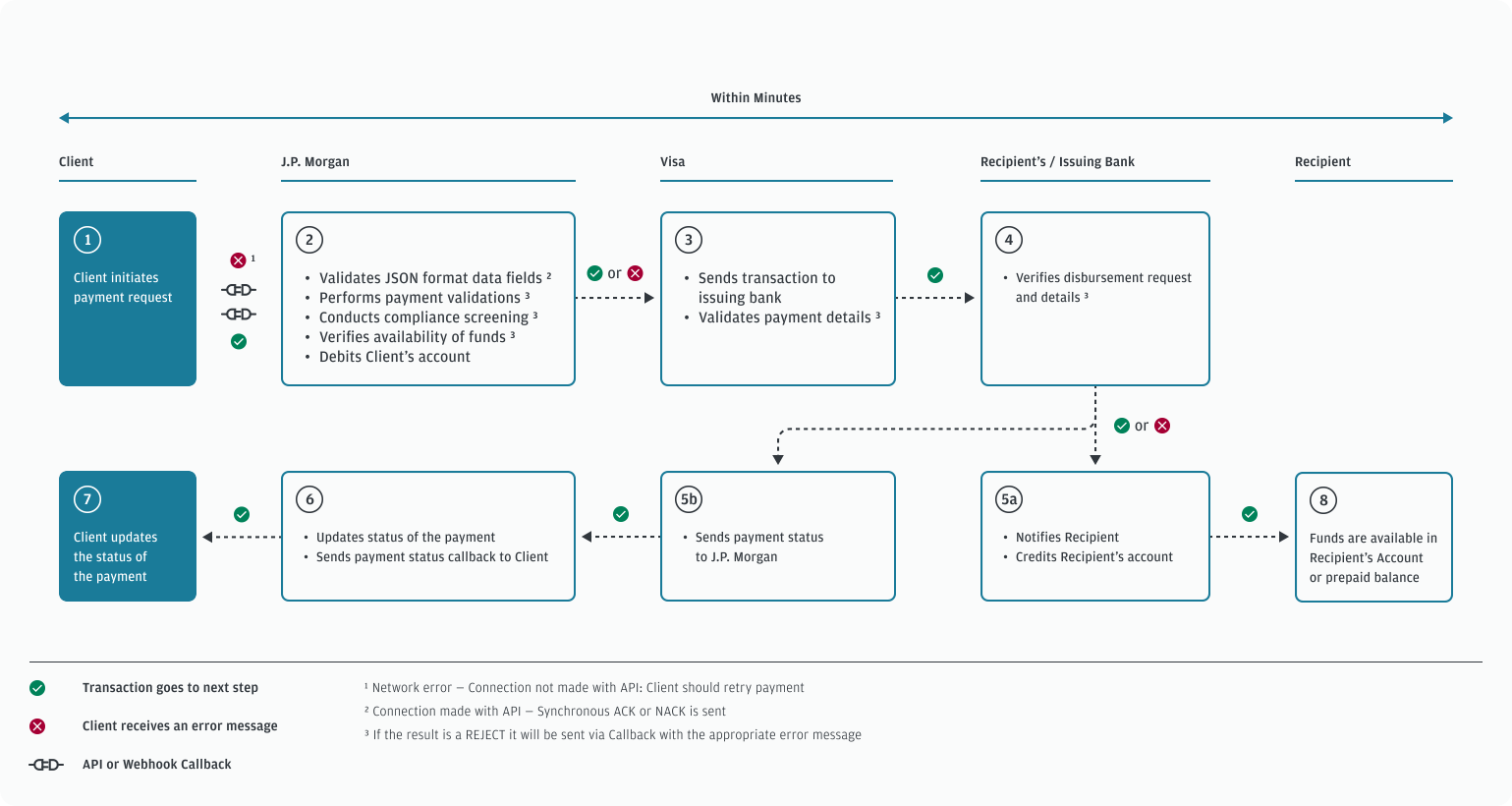

Push payments occur when an individual or a business sends (pushes) funds directly to a recipient’s card account. This process is referred to as an Original Credit Transaction (OCT). OCTs offer real-time posting and immediate credit to the cardholder, typically within a maximum of 30 minutes. The funds on the card can then be used just like cash.

The following diagram depicts the high-level end-to-end payment flow:

Availability

Push to Card is available on the Global Payments API in the following regions and markets:

| Regions | Market/Scheme |

|---|---|

| North America (WHEM) |

|

Next steps

- Learn how to initiate a Push to Card payment.

- Understand required payment parameters.