Same Currency Wire

Wire payments are a secure way to move electronic funds from one party to another across a network of banks and transfer agencies around the world.

Transfers can occur between individuals, between banks, or using a third-party service. Wires, which are usually high-value payments, can be conducted both domestically and internationally. They can be processed in the same currency or through cross-currency foreign exchange (FX).

Benefits

When you use the Global Payments API to send wire payments, you gain access to the following benefits of banking with J.P. Morgan:

Global Clearing

J.P. Morgan is one of the largest Global Clearing Banks with up to $10 Trillion processed a day.

Processing Speed

J.P. Morgan offers processing often in under 2 minutes with a High STP Rates of 99.4% and a book transfer rate of 65.9%.

Principal Protect

J.P. Morgan provides a principal protect feature offered with a robust set of capabilities.

When to use wire payments

The following are some common use cases that show when wire payments are the best option.

- Treasury settlements: Easily transfer funds globally to optimize liquidity structures, ensuring that funds are available where needed, while any excess is invested.

- Domestic and cross-border payments: Easily pay suppliers and vendors, whether domestically or across borders.

- Tax payments: Businesses can easily pay taxes directly from their bank account to their tax entity from anywhere in the world.

How wire payments work

Processing

Processing a wire payment involves clearing and settling the transfer:

- Clearing: The transfer and confirmation of information between the payer and payee. All transfers must pass through a domestic clearing house before settlement.

- Settlement: The actual transfer of funds between the payer and payee’s financial institution.

Messaging

Wire transfers require the transmission of payment codes and banking instructions through a secure system such as SWIFT (Society for Worldwide Interbank Financial Telecommunication). SWIFT provides a network that allows financial institutions around the world to send and receive information about financial transactions.

SWIFT doesn't facilitate the transfer of funds directly. Instead, it sends and receives payment orders, which must be settled through correspondent accounts that financial institutions maintain with one another.

Types of clearing

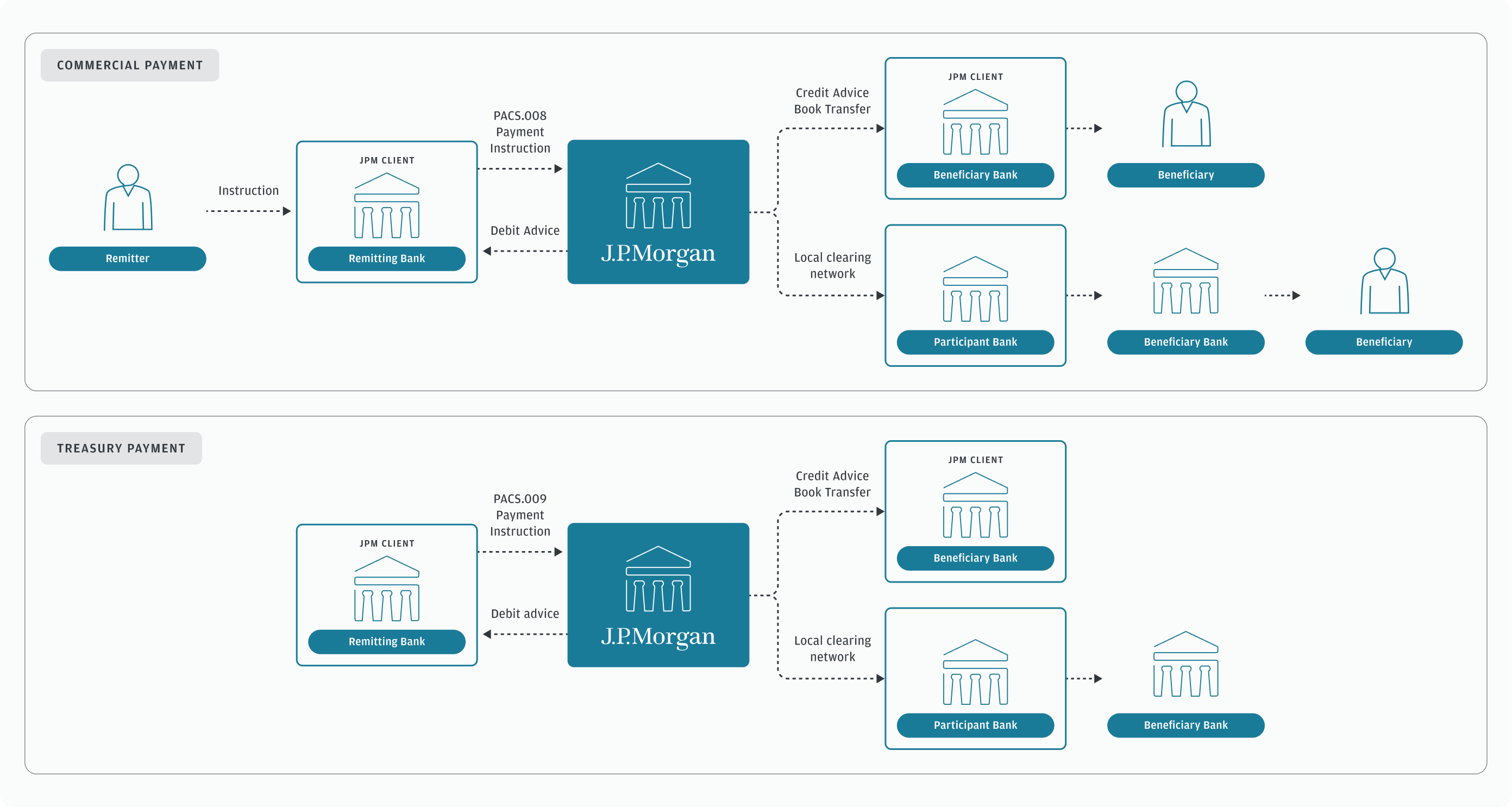

The following diagrams illustrate the flow of a wire transaction and the clearing process for both individual and bank-initiated transfers.

Straight through processing flow

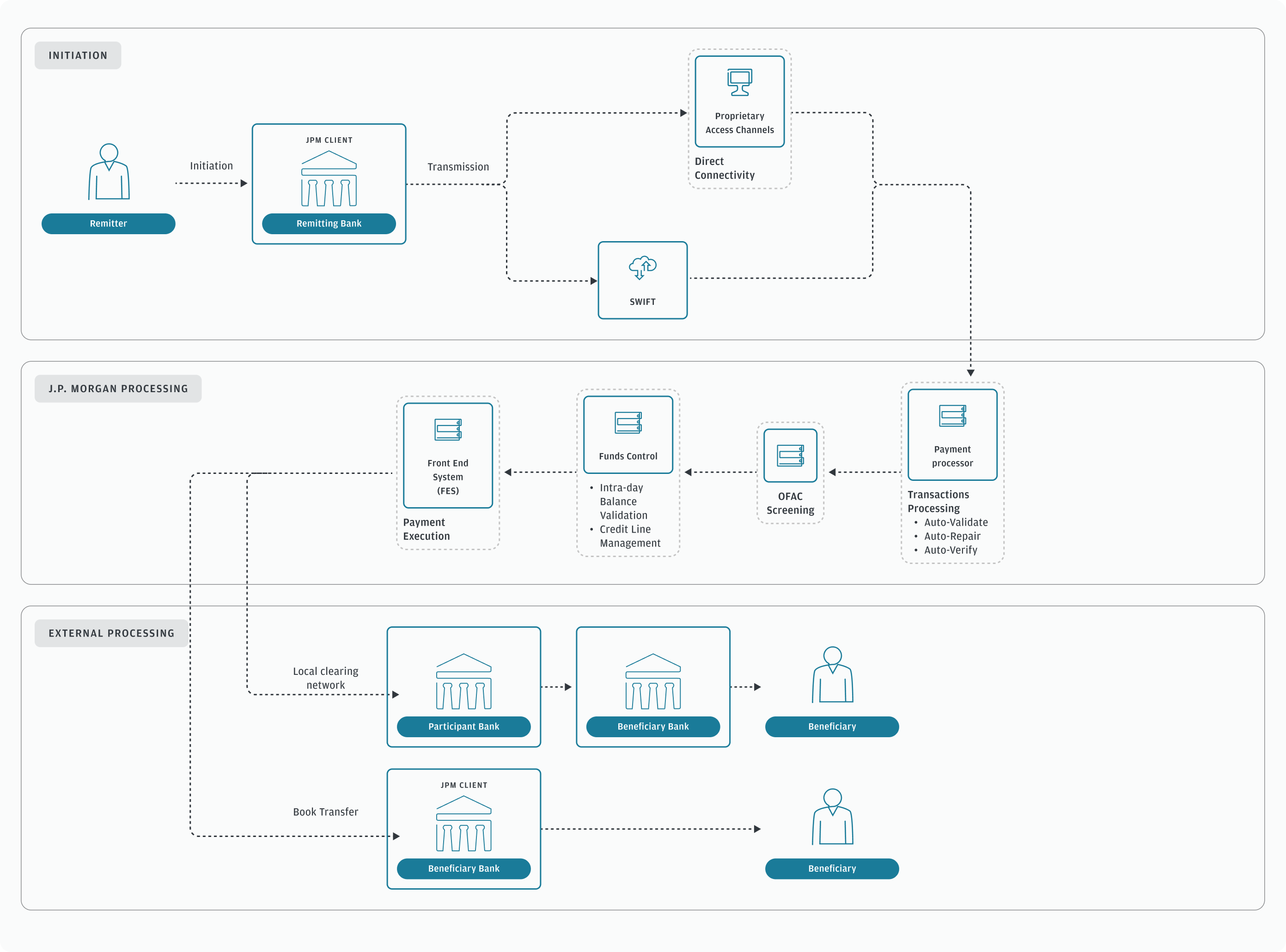

The following diagram illustrates the end-to-end processing flow of a wire transaction.

Cross-border flow

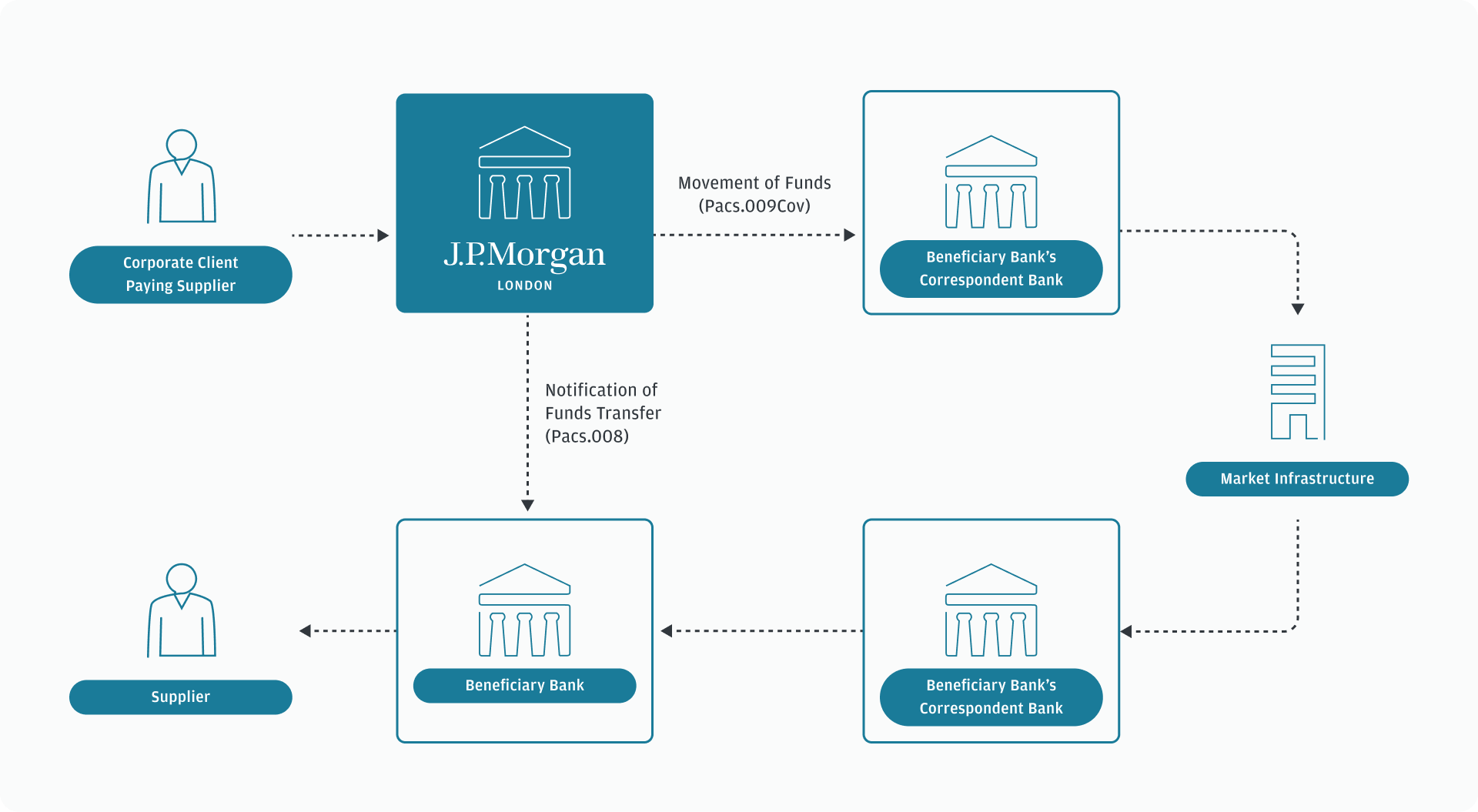

Cross-border wire payments require the use of correspondent banks. The following diagram illustrates the flow of a cross-border wire payment, where both the remitter and beneficiary are located outside the country of the payment currency.

Sending wires with the Global Payments API

The Global Payments API allows users to initiate wire credit transfer payments in a manner that is both lightweight and robust.

A POST request communicates the details of the payment details, and the synchronous ACK/NACK provides real-time confirmation on whether the request has passed the initial processing stage. The J.P. Morgan Payment Status Track-n-Trace API offers ongoing status tracking information for these transactions.

Availability

Wire payments are currently available for Global Payments API initiation in the following regions and markets.

| Regions | Market/Scheme |

|---|---|

| Europe, Middle East, and Africa (EMEA) |

|

| North America (NA) |

|

Next Steps

- Learn how to initiate a wire payments request.

- Understand the required payment parameters for your region.