Real-Time Payments

Real-Time payments (RTP) is an emerging transaction rail that combines immediate funds availability, settlement finality, instant confirmation, and integrated information flows, all within seconds. With RTP both payments and returns can be initiated, processed, and settled instantaneously.

Capabilities

This page covers the following capabilities:

- Payments: Send funds instantly with immediate availability, settlement finality, instant confirmation, and integrated information flows. With RTP, payments are initiated, processed, and settled within seconds.

- Returns: Client-initiated returns allow businesses to efficiently manage return payments by ensuring funds are returned to the payor in real-time. This improves cash flow, enhances customer satisfaction, and streamlines financial operations.

Benefits

Experience the benefits of Real-Time Payments across the payment lifecycle.

- 24/7 availability: Instant payments and returns are available around the clock, with no cutoff times, ensuring continuous operation.

- Speed and transparency: Funds are available to the payee or returned to the payor within seconds, providing immediate access and use.

- Finality: Transactions are irrevocable, ensuring certainty and security in payment processing.

- Instant pocessing: Both payments and returns are processed immediately, ensuring quick resolution and efficiency.

- Enhanced API experience: The use of APIs facilitates new market enablement, sophisticated applications, and simplifies processes like messaging and return initiation.

- Improved business operations: Automatic reconciliations and improved liquidity management enhance business efficiency.

- Increased disbursement success rate: Support for high-volume transactions improves the success rate of disbursements.

- Real-time visibility: Instant payment finality and visibility provide a real-time view of cash positions and confirmations.

- Extensible messaging: Supports more sophisticated applications, such as confirmation notifications and callbacks, enhancing communication and process management.

Real-Time Payments

RTP lets business send funds in real time from a bank account to a beneficiary's bank account or alias (e.g., email ID, mobile number). Payments are initiated and settled within seconds, any day of the year, including weekends and holidays.

When to use Real-Time Payments

RTP is ideal when speed, certainty, and immediate access to funds are important, such as for payouts, bill payments, or other time-sensitive transactions.

Wallet withdrawals

Give users immediate access to funds by initiating transfers from digital wallets to bank accounts.

Instant payroll

Empower employees with on-demand payouts for their earned wages.

Merchant payouts

Give merchants the flexibility to access their funds on demand.

Vendor payments

Pay vendors for services and goods provided and reduce costly follow-ups.

Urgent payments and payroll

Make urgent payments to employees with speed and finality.

Bill payments

Confirm received payments in real-time, reducing support calls.

How Real-Time Payments works

RTP transactions are made between two bank accounts or aliases, such as an email address or mobile number, and are both initiated and settled within seconds. Real-Time Payments can occur at any time of day, on any day of the year, including weekends and holidays.

Whether it’s a business making a cross-border payment, a worker sending remittances within their own country, or e-commerce consumers making instant transactions, the demand for Real-Time Payments capabilities is growing.

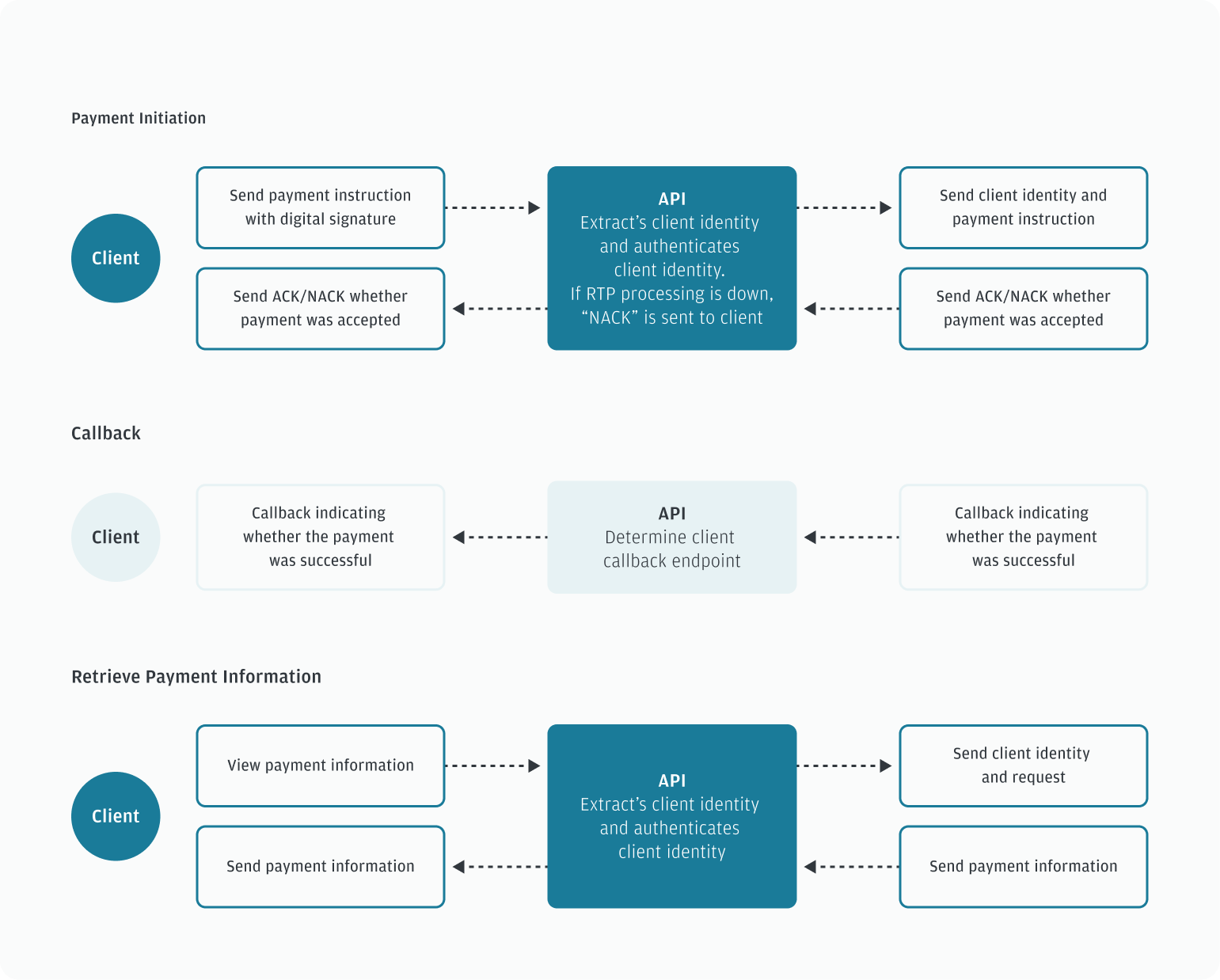

The Global Payments API supports three key Real-Time Payments actions:

- Initiate a payment: Submit a payment request by submitting the minimum required payload for your region to the Global Payments API

/paymentsendpoint. - Determine success of the payment: Enable callbacks for automatic status updates, or manually check the status of your payment request.

The diagram below illustrates the high-level end-to-end flow for RTP transactions.

Availability

Real-Time Payments is available in the following regions and markets:

| Regions | Market/Scheme |

|---|---|

| North America (NA) | United States

Canada

|

| Europe, Middle East, and Africa (EMEA) |

|

| Asia-Pacific (APAC) |

|

| Latin America (LATAM) |

|

Real-Time Payments Returns

Client-initiated returns allow businesses to efficiently manage return payments by ensuring funds are returned to the payor in real-time. This improves cash flow, enhances customer satisfaction, and streamlines financial operations.

When to use client-initiated returns

Client-initiated returns support a variety of use cases where funds need to be sent back to the payer quickly and securely. Examples include:

Retail refunds

Issue refunds in real-time for returned merchandise.

Service cancellations

Return payments in real-time for canceled subscriptions or services.

Error corrections

Correct payment errors in real-time.

Invoice adjustments

Adjust overpayments or invoice discrepancies efficiently.

Credit note issuance

Process credit notes for returned goods or services.

How client-initiated returns work

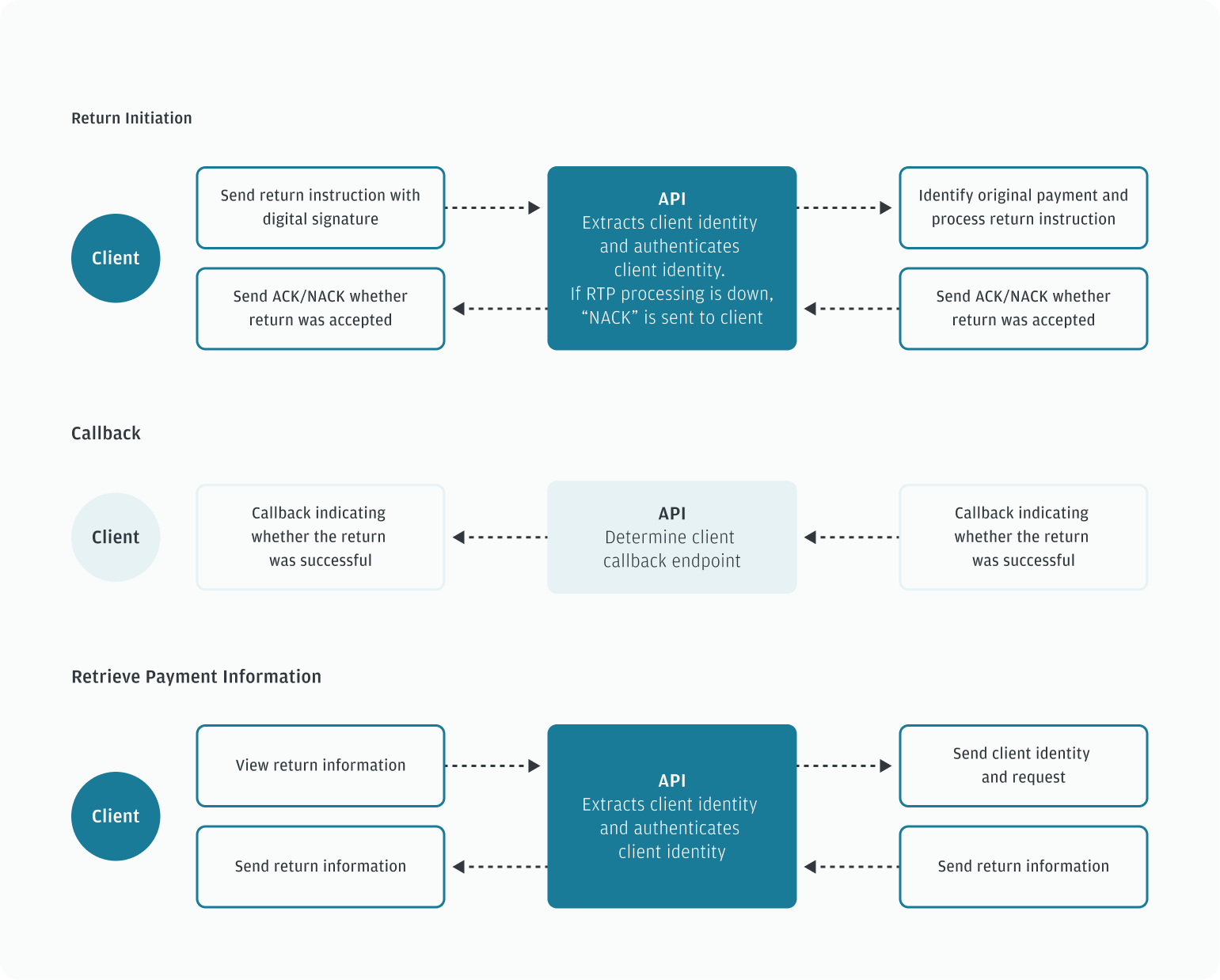

The Global Payments 2 API supports three key client-initiated return actions:

- Initiate a return: Submit a return request by providing the minimum required payload for your region to the

/returnsendpoint of the Global Payments 2 API. - Determine the success of the return: Enable callback webhooks for automatic status updates.

- Retrieve payment status: Manually check the status of your payment request.

The following diagram illustrates the high-level end-to-end flow for client-initiated return transactions.

Availability

Client-initiated returns are available in the following regions and markets:

| Regions | Market/Scheme |

|---|---|

| Latin America (LATAM) | Brazil (PIX) |

Next steps

- Learn how to initiate a Real-Time Payments request.

- Understand the required payment parameters for your region.