ACH

Automated Clearing House (ACH) payments, also known as low value, non-urgent, eCheck (in some jurisdictions), or electronic funds transfer (EFT) payments, allow customers to transfer funds directly from one bank account to another for a multitude of purposes, including inter-company transfers; payments to suppliers, customers, and tax authorities; collections for bills; loan repayments. ACH payments are not settled immediately, unlike other payment methods like Real Time Payments, wires, credit or debit card transactions; and they are typically lower in value compared to wires. However, ACH payments are often comparatively cheaper options for businesses due to lower processing fees, and they allow for both payments (credits) and collections (debits) to be initiated in most markets.

Benefits

Key features for ACH include:

- Cost effectiveness: Low-cost solution for non-urgent payments.

- Speed and safety: Fast and secure payments that reach the beneficiary on the same or following business day(s).

- Credits and debits: One payment solution to meet both collection and payable needs.

When to use ACH

Payroll payments

Supplier and vendor payments

Bill and tax payments

Customer reimbursements and refunds

Issue refunds or reimbursements that reach customers in a few days.

Wallet top-up and withdrawal

Top-up stored-value digital wallets directly from bank accounts and withdraw excess money directly into bank accounts.

How ACH works

ACH payments, also known as electronic funds transfer (EFT), electronic bank transactions, direct debits and eCheck (in some jurisdictions) payments, allow customers to use their account number and bank or credit union’s routing number to pay for goods and services. These payments are processed through each country’s ACH network and follow rules and guidelines set by local bodies.

In the US, it is known as the ACH Network and adheres to rules set by the National Automated Clearing House Association (NACHA). In the UK, it is known as BACS (Bankers’ Automated Clearing Services), and standards are set by Pay.UK. In Singapore, it is known as GIRO (General Interbank Recurring Order), with standards of good practice set by the Association of Banks in Singapore (ABS).

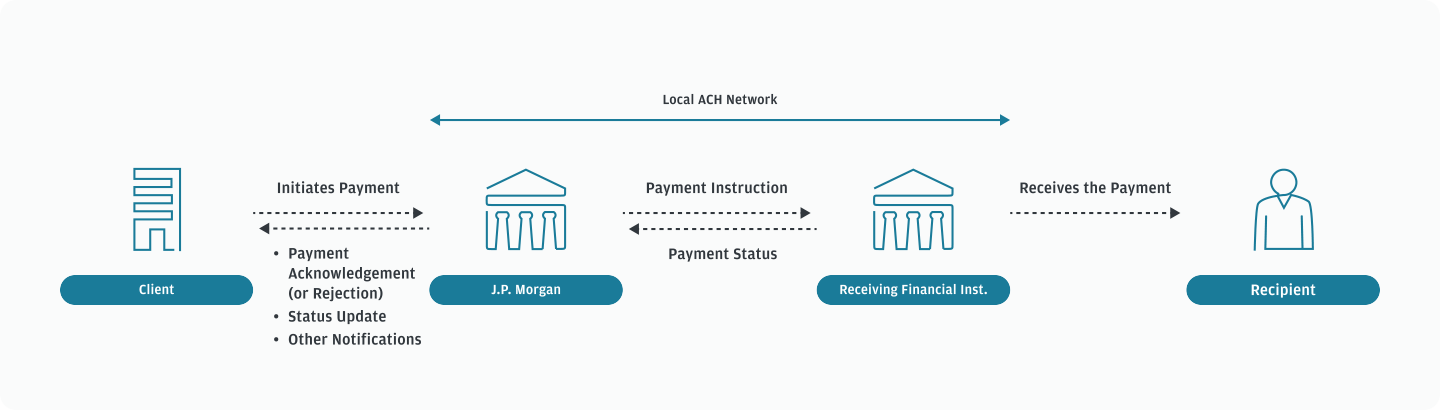

The following image is an example of an ACH flow:

ACH supports both one-time and recurring payments made directly from your customers’ bank accounts. In accordance with local rules and regulations, your customer must authorize you to debit or credit their bank account prior to submission of the initial ACH transaction.

The ACH payment type (paymentMethodType.ach.paymentType) is determined by how your customer initiates their ACH transaction. We support the following payment types in some regions:

- paymentMethod = "TRF" for Credits

- paymentMethod = "DD" for Debits

- paymentTypeInformation.serviceLevelCode = "NURG" for low value payments

Availability

ACH is currently available for Global Payments API initiation in the following regions and markets:

| Regions | Market/Scheme |

|---|---|

| Latin America (LATAM) | Chile |

ACH in Chile

Cámara de Compensación Automatizada or Automated Clearing House (ACH), enables Chilean customers to use direct payments to transfer funds from one bank account to another without the use of checks, credit cards, or cash.

J.P. Morgan processes ACH transactions in Chile using Low-Value payments. Companies can use Low-Value ACH for payroll, suppliers, dividends, insurance reimbursements, and more. Customers can also use Low-Value ACH to pay to savings and basic account types such as cuenta vista/RUT.

Key features for Low-Value ACH include:

- Transactions are sent on T and settled on T+1 (i.e. if a transaction occurs on a Monday, the settlement must occur by Tuesday).

- Receive instant confirmations within seconds (returns information only on T+1).

- Low-Value ACH supports high volumes of ACH transactions or payments.

- Use the Centro de Compensación Automatizado (CCA) Clearing House.

How Low-Value ACH works in Chile

J.P. Morgan’s Low-Value ACH Chile transactions are local, prefunded ACH payments. These transactions debit to a Chilean client’s Direct Deposit Account (DDA) on T+0 (same day) and credit to the beneficiary’s account on T+1 (the following business day).

The local clearing for Low-Value ACH payments in Chile operates under a negative consent logic. This logic means that only payments that are returned by beneficiary banks (not credited to the beneficiary) are informed to the ordering bank. Otherwise, the payment is considered completed.

While the cut-off time for local Low-Value ACH payments is 4 PM local time on business days, J.P. Morgan processes payments instructed after the cut-off time on a best-effort basis. Returns generated by beneficiary banks are credited to a customer’s account on T+1 between 9 – 12 AM local time. Customers can also reconcile returns via API or other channels. Reconciliation tools are available in formats such as MT940/942, CAMT, and BAI reports.

Next steps

Learn how to initiate an ACH payment request.