Payments participants and lifecycle 101

6 September 2024

Overview

Whether you’re new to payments or have been developing financial applications for decades, the landscape of payments is continually changing. In this blog, we’ll explore some of the fundamentals of payments. This includes who the key participants involved in a payment are and how the payment lifecycle works.

Participants

Let’s first identify the key participants involved in a payment. While not all payment types involve the same participants, these are some of the most common parties involved when a payment is made.

Customer

Customers initiate the transaction and purchase the goods or services from a merchant. A customer in a payment transaction can be an individual, or a business who is purchasing from one of their vendors.

Merchant

A merchant is the entity that is selling a good or service to a customer. Customers and merchants share similar personas, in that a merchant can also be an individual or a business.

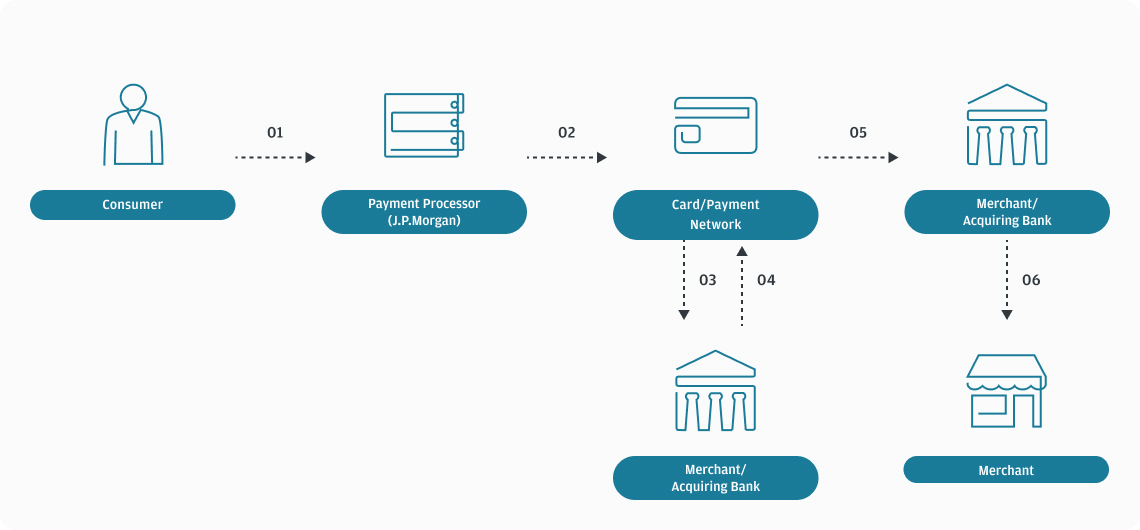

Issuing bank

Issuing banks provide debit and credit cards to customers. They also authorize card payments and settle funds to acquiring banks, and they send the payment on behalf of the customer. Examples of issuing banks include Chase and other financial institutions that issue cards to their customers.

Acquiring bank

The acquiring bank in a payment receives the payment on behalf of the merchant. Chase is also an example of an acquiring bank.

Payment network

Payment networks facilitate transactions and the transmission of data between the various parties involved in a transaction. There are a few well known payment networks:

Card networks

- Visa

- Mastercard

- American Express

- Discover

Non-card networks

- Automatic Clearing House (ACH)

- Society for Worldwide Interbank Financial Telecommunication (SWIFT)

Payment processor

Payment processors are financial institutions or third-party companies that handle the processing of payment transactions on behalf of merchants. For example, a payment processor can be the entity that sends the transaction information over to a payment network and handles that process for the merchant. J.P. Morgan Payments can play the role of a payment processor. We handle over 50% of all e-commerce transactions (Nilson Report, March 2024) in the United States and $10 trillion in daily transaction volume globally. (J.P. Morgan proprietary data, 2023)

Here is a diagram showing a card transaction and the roles of each of the participants:

Understanding the Payments Lifecycle

A payment consists of a series of events that can be thought of as a lifecycle. As mentioned above, while not all payments are the same, there are some distinct steps common to most payment types.

One thing worth keeping in mind is that payment processors play a central role by acting as the communication hub between issuing banks, acquiring banks and payment networks. For the following steps, let’s assume that J.P. Morgan Payments is the payment processor.

Payment verification

Before a payment is initiated, J.P. Morgan validates the customer’s payment account to help ensure they are in good standing. Not all payment methods can be verified, but card-based payments are the most common. Things like address-on-file matching, card verification value/code (CVV/CVC, or the three- or four-digit number on the back of a card) and other account-level information can be used.

Payment verification is an important step that helps prevent fraud and mitigates the risk of unauthorized transactions.

Payment authorization

Authorizing a payment is the first part of the payment request process. During authorization, the issuing bank will decide if the payment should be authorized or not. If J.P. Morgan were the payment processor for this transaction, we would send the authorization request to the issuing bank to obtain approval for the payment.

Payment authorization checks the customer’s account to ensure sufficient funds or enough available credit, and to check if the account is in good standing. This is why there can be funds pending or on hold for up to 30 days before a payment is completed.

Payment capture

The merchant requests the capture after payment authorization is approved by the issuing bank. J.P. Morgan Payments will capture transaction-level information such as payment details, customer account details and the authorization code received from the issuing bank.

Payment settlement

After the payment is captured, payment settlement occurs. Payment settlement will complete the transaction and transfer funds from the customer’s account to the merchant’s account.

Payment reversal

There can be times when a transaction doesn’t go quite as expected. The three methods of payment reversal are:

- Authorization reversals: Occurs immediately after a transaction was authorized, but before settlement. A common cause of this is incorrect information entered by the customer, such as their payment address.

- Refund: Occurs after settlement as an entirely new transaction from the merchant back to the customer. Refunds are usually initiated by the customer requesting one from the merchant.

- Chargeback: A chargeback occurs when a customer reaches out to their bank and files a dispute against the merchant. This can occur if the customer is unsatisfied with their good or service and the merchant refused a refund. It can also occur if the customer prefers to go through their bank instead of requesting a refund from the merchant.

Next Steps

Now that you understand the key participants and the lifecycle of a payment, you can explore our resources on sending payments and accepting payments.